Shield Your Hard-Earned Wealth from Legal Threats with a Nevis LLC

Setting up an offshore limited liability company in St. Kitts and Nevis can protect your assets from U.S. creditors, judgments, and lawsuits. Contact our team to start the formation of your Nevis LLC.

What Is a Nevis LLC?

U.S. asset protection methods such as domestic trusts and limited liability companies can only shield your assets to a certain degree. Courts in the United States do not always respect these legal structures, and in many parts of the country a single-member LLC can be subject to seizure if a creditor wins a favorable judgment. In contrast, a Nevis limited liability company offers superior privacy and asset protection.

Why Should You Consider a Nevis LLC?

Not sure whether a Nevis LLC is right for you? Here are some reasons to consider this asset protection method:- Protection from U.S. judgments: Nevis law does not recognize judgments from overseas courts. To reach your offshore assets, a U.S. plaintiff would need to file a lawsuit in a local court, incur extensive costs, and navigate a legal system that heavily favors the defendant.

- Privacy and confidentiality: Offshore asset protection provides you with much more discretion. Unlike many LLCs in the United States, you do not have to list Nevis LLC ownership on any public database or record.

- Reasonable costs: Setting up a Nevis LLC is relatively affordable and can be more affordable than domestic alternatives. At Blake Harris Law, we offer competitive rates for Nevis LLC formation, including comprehensive asset protection packages with additional offshore instruments.

- Flexibility: You do not need to visit St. Kitts and Nevis to form an LLC in the country. A U.S. attorney from our office can assist you in forming the company with the assistance of a local representative. Your LLC can also have an unlimited number of members and hold assets both in Nevis and abroad.

- Minimal maintenance: Nevis LLCs have minimal upkeep requirements.

Why work with Blake?

Attorney Blake Harris is passionate about helping you protect your assets from lawsuits. Before founding Blake Harris Law, Blake worked for one of the largest wealth management firms in the United States, where he helped high/ultra-high-net-worth clients protect their personal assets. Since then, Blake has gained extensive experience in all areas of asset protection and has assisted clients worldwide with asset protection planning.

Over the years, Blake has built and continues to nurture a vast network of legal and finance professionals in countries such as Belize, the Cayman Islands, the Cook Islands, Lichtenstein, New Zealand, Panama, St. Kitts and Nevis, and Switzerland. Blake’s knowledge, experience, and connections enable him to handle even the most complex and sensitive asset protection issues that other attorneys find challenging or are unwilling to represent. Whether you are looking to set up an offshore trust, establish a foreign limited liability company, or protect your digital assets, Blake will work hard to protect your wealth.

As the United States remains one of the world’s most litigious countries, it’s more critical than ever to consider the risks of lawsuits. While many people now use LLCs, trusts and other asset protection methods to shield their assets from creditors and lawsuits, the courts in the U.S. do not always respect the integrity of these legal structures.

The more sophisticated individuals are now turning to offshore LLCs to secure their assets. The Caribbean island of Nevis has become one of the world’s most favorable locations to establish limited liability companies for both privacy and asset protection. The small island country’s commitment to providing safe legal arrangements for overseas residents has been proven since the passage of the Nevis Business Corporation Ordinance in 1984.

Below, we will discuss the asset protection benefits afforded by Nevis LLCs, and how this unique protection mechanism compares to other options available to U.S. residents.

What Is Asset Protection?

Asset protection refers to any legal arrangement or method used to protect your assets from lawsuits, creditors, and other legal threats against you. If a judgment is issued against you, creditors could have the right to seize assets owned by you.

By forming limited liability companies, trusts, and other legal entities, you can separate yourself from the assets you own. Some forms of asset protection can also be used for estate planning purposes. For example, forming trusts can help streamline the succession process and protect the assets received by the individuals that inherit your estate. If protecting your assets is your priority, it’s important to form a comprehensive strategy that takes into consideration your particular situation, goals, and needs. A Nevis LLC may be one component of a much broader effort to shield your assets from creditors and potential legal complaints.

Nevis LLC for Offshore Asset Protection

In 1984, the Nevis Business Corporation Ordinance put the wheels in motion for overseas individuals to register limited liability companies in Nevis. The island became firmly committed to offering a haven for individuals who want to protect their assets from unfair judgments and other frivolous lawsuits. Nevis LLCs only allow charging liens for creditors seeking asset recovery – and these charging liens expire after three years. Additionally, the charging lien must be sought in a Nevis court. A charging lien issued by a court in the U.S. is not recognized in Nevis, so the plaintiff would be forced to relitigate the matter in Nevis.

At present, there are no examples of U.S. creditors successfully seeking charging orders against a Nevis LLC from a U.S. court.

Unlike other offshore jurisdictions, Nevis benefits from political stability and discretion. You don’t have to publicly record ownership and other key details about your LLC. Additionally, there are tax advantages and you don’t have to submit annual financial statements or documents to the government of St. Kitts and Nevis in order to maintain your Nevis LLC.

Nevis LLCs help you protect your assets, but they can also provide strategic advantages if you are facing pursuit from creditors. If creditors understand you have overseas assets with strong safeguards, the cost of seeking those assets is high. You can use this position to negotiate lower debt settlements or arrangements.

Limited Liability Companies for Asset Protection

The effectiveness of using limited liability companies for asset protection varies depending on the company’s location. For example, if you own a single-member LLC in many parts of the United States, it can be seized if a creditor wins a favorable judgment. While LLCs do provide a degree of protection, it’s best to register them overseas if you want the maximum protection for your assets.

Nevis LLC Formation and Management

If you believe a Nevis LLC is a suitable option for your financial interests, it’s critical to begin the process of forming the LLC sooner rather than later. The longer you wait, the more exposure you have to negative credit events. If a legal judgment is brought against you before you’re able to form a Nevis LLC, you may not be able to shield your assets from your creditors’ hands.

You don’t need to visit Nevis to form an LLC on the island. Instead, you can use a U.S. based attorney to help form the company using a Nevis-based representative. This means the formation process can be streamlined and prompt. The company can hold assets in Nevis or another overseas jurisdiction. You can choose to transfer assets abroad or assign them to your Nevis LLC.

You will need to appoint a company manager, which can be either yourself or a third party. Appointing a family member or third party is often an advantageous way to secure your LLC against creditor actions. Many people choose managers located outside of the United States to avoid potential liability.

Nevis LLC vs. Other Asset Protection Arrangements

If you are considering a Nevis LLC for asset protection, it’s essential to consider other legal arrangements that carry similar benefits. Below, we’ll explore how Nevis LLCs compare to other popular asset protection options.

Nevis LLC vs. Cook Islands LLC

Nevis LLCs and Cook Island LLCs are very similar. Both offshore limited liability company arrangements provide ample asset protection. While both only allow creditors to seek money using charging orders, these charging orders expire more quickly for Nevis LLCs. With a Nevis LLC, all charging orders expire within three years. On the other hand, Cook Islands LLCs have a five-year expiration date on charging orders. For this reason, Nevis LLCs are preferable for individuals seeking asset protection.

LLC vs. Trust

An LLC forms a company, but a trust is a legal arrangement that designates assets for beneficiaries. While there are clear differences between these two legal formations, they can both serve as asset protection vehicles for U.S. residents. Both LLCs and trusts provide a degree of separation between yourself and your designated assets.

While many state and federal laws protect your LLC assets from creditor actions, you’re not entirely safe if you own a U.S. based LLC. On the other hand, if you choose to form a U.S. based asset protection trust, your assets are still vulnerable to an unfavorable judgment from a U.S. court ruling.

LLC vs. Corporation

LLCs and corporations share many common traits, but small differences make LLCs much more suitable for asset protection purposes. Corporations are often formed for companies with a larger number of owners. They’re suitable legal entities if you want your company’s stock to be publicly traded. Unfortunately, this means their regulations are much more rigid. While corporations still provide limited liability benefits for owners, LLCs are generally more suitable for asset protection.

Nevis LLC Benefits

If you’re going to consider a Nevis LLC for asset protection, it’s critical to understand the benefits. Below are the primary advantages associated with forming Nevis LLCs for asset protection:

Overseas

As your Nevis LLC is located outside of the United States, you have an added degree or protection from U.S. based judgments. While authorities may choose to pursue charges against your LLC, it’s much harder to pursue and obtain a favorable judgment in an overseas court. Additionally, the nature of an overseas LLC means it’s much more expensive for creditors to pursue. This increased difficulty is a powerful deterrent for creditors that don’t want to incur high costs while pursuing assets abroad.

Successful Asset Protection Track Record

Nevis has an extremely successful asset protection track record. If you are searching for a jurisdiction that’s committed to shielding your assets from creditors, it’s essential to consider the country’s track record.

Privacy

Another underlying benefit of offshore asset protection is that it provides more privacy for you and your family. If you value discretion, using a foreign asset protection vehicle like a Nevis LLC is an excellent option. Unlike most LLCs formed in the United States, a Nevis LLC’s ownership is not listed on any public database or record.

Formation Convenience and Speed

While forming an overseas LLC might sound like a logistical nightmare, you can register a new company in Nevis relatively quickly. If you want to start safeguarding your assets immediately, a Nevis LLC allows for quick and convenient setup. At Blake Harris Law, we offer rapid turnaround times for clients seeking Nevis LLCs. Don’t hesitate to contact us if you want to start the formation process.

Stable Political Environment

Using offshore asset protection methods isn’t without its risks. You need to choose a country that has a stable political environment. Otherwise, a change in government or regulation could leave you exposed. Nevis is known for having a stable, business-friendly political system that’s focused on attracting and protecting financial capital in the island.

Cost

Many people make the mistake of thinking asset protection is only for the extremely wealthy. Forming LLCs in Nevis is affordable – you don’t need to break the bank to afford the legal protections of a Nevis-based limited liability company. Our team at Blake Harris Law offers competitive rates for Nevis LLC formation and legal counsel. We can also combine a Nevis LLC with other asset protection entities for added security such as a Cook Islands Trust. Feel free to contact us to learn more about pricing and other costs associated with creating a Nevis LLC.

Minimal Maintenance

Nevis LLCs provide excellent benefits without extensive maintenance requirements. In most cases, you won’t have to submit annual financial reports or returns, which makes the process of maintaining your LLC much easier. If you’re searching for an asset protection arrangement that doesn’t require constant upkeep, this is a suitable option.

Are Nevis LLCs Legal?

Yes. Nevis LLCs are entirely legal for U.S. citizens, U.S. residents, and others – you are simply forming an overseas limited liability company that must conform to local laws and regulations. If you are searching for a legal asset protection method, Nevis LLCs are an excellent option.

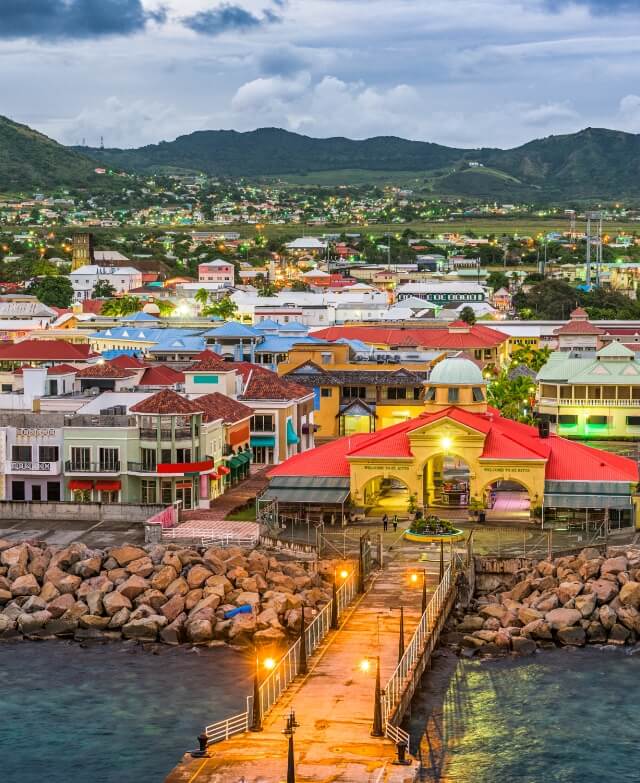

About Nevis

If you plan to use an offshore LLC to protect your assets, it’s essential to understand the country that’s hosting your company. Nevis is a small island in the West Indies. Along with neighboring island Saint Kitts, it forms the country officially known as the Federation of Saint Christopher and Nevis. The island of Nevis has a full-time population of just over 11,000. While it has an excellent reputation with tourists, much of the local economy is driven by its status as a secure offshore hub for company formations and bank accounts. The country is firmly committed to secrecy.

Contact Blake Harris Law Today to Create Your Nevis LLC

If you are ready to secure your financial future, it’s time to contact our asset protection attorneys at Blake Harris Law. Our comprehensive approach to asset protection ensures we cover all the bases – this is critical if you want your assets to remain as secure as possible.

We start by providing a free consultation that outlines your financial goals. As we have considerable experience in the world of asset protection, we can form a bespoke plan to protect your interests. Don’t hesitate to contact us today if you’re ready to take advantage of Nevis LLCs or other asset protection arrangements.

Let’s Have a Talk

Have questions? Fill out the form below to talk to an experienced asset protection attorney.

"*" indicates required fields

Frequently Asked Questions

Regarding Nevis LLC

A Nevis LLC, or Nevis Limited Liability Company, is a type of offshore business structure established under the laws of Nevis, a small island nation in the Caribbean. It offers significant advantages for asset protection and privacy, particularly for individuals seeking to safeguard their wealth from potential legal challenges or creditors.

Nevis LLCs offer robust asset protection due to Nevis law, which does not automatically recognize judgments from foreign courts. This means a creditor would need to file a new lawsuit in a Nevis court to pursue assets held within the LLC, a costly and challenging process that deters many creditors.

While both offer limited liability protection, Nevis LLCs provide superior asset protection. U.S. courts can often pierce the corporate veil of a U.S. LLC, especially single-member LLCs, to reach assets. Nevis law makes it extremely difficult for creditors to do so, requiring them to navigate a separate legal system with stricter regulations.

The cost of setting up a Nevis LLC can range from $5,000 to $20,000, depending on various factors like legal fees, registered agent costs, and government filing charges. Thankfully, maintenance costs are minimal. Nevis LLCs are generally exempt from local taxes and do not have strict reporting requirements like certain financial statements.

No, you do not need to travel to Nevis to establish your LLC. The entire process can be handled remotely with the assistance of an experienced attorney like Blake Harris Law. We will work with local Nevisian representatives and guide you through each step, ensuring a smooth and efficient formation process.

Forming a Nevis LLC typically takes one to two months. However, various factors can influence the timeline, including the complexity of your asset portfolio, due diligence checks, and the speed of government processing.

Yes, Nevis LLCs are perfectly legal for U.S. citizens and residents. Forming a Nevis LLC is simply utilizing legal provisions for establishing an offshore company to protect your assets and enhance privacy. As long as you comply with U.S. tax laws and reporting requirements for foreign assets, a Nevis LLC can be a valuable component of your asset protection strategy.