Quick Summary

Irrevocable trusts are not tax-free entities, they have specific filing and tax obligations that must be met to stay compliant with IRS rules. This article explains when filings are required, how irrevocable trusts are taxed, and who handles the reporting. You will also discover why offshore irrevocable trusts may offer stronger protection. Visit our blog for more insights on safeguarding your wealth.

Want to Know If Your Irrevocable Trust Has a Tax Filing Requirement?

Generally, an irrevocable trust must file tax returns, but not in every case. Whether a trust must file depends on its classification and how it handles income.

This Blake Harris Law article breaks down the key rules that determine tax filing requirements for irrevocable trusts. We will explain who files the return, when Form 1041 is required, and how income taxes are handled between the trust and its beneficiaries.

Why Listen to Us?

We help our clients protect their assets, including structuring and maintaining irrevocable trusts. With years of legal experience and a client base spanning high-net-worth individuals, our team understands the tax and compliance details that matter. We provide trusted, legally sound guidance tailored to protect wealth with precision.

Tax Benefits of Irrevocable Trusts

An irrevocable trust is a legal arrangement that permanently transfers assets out of your name and places them under the control of a trustee. It offers asset protection, financial privacy, and control over wealth distribution. One of its key advantages is its potential to reduce tax exposure.

By removing assets from your taxable estate, an irrevocable trust may lower both estate and income tax liabilities. In some cases, income generated within the trust is taxed at the beneficiary’s rate, which may be lower than the trust’s rate.

These features make irrevocable trusts a practical tool for high-net-worth individuals seeking long-term protection, tax efficiency, and planning flexibility.

Do Irrevocable Trusts File Tax Returns?

Yes. In most cases, irrevocable trusts must file a tax return. Once assets are transferred into an irrevocable trust, it becomes a separate legal and tax entity.

This requires the trustee to obtain a tax identification number and file IRS Form 1041 if the trust earns income or meets other filing requirements. Even if the trust distributes all its income to beneficiaries, it may still be required to file.

Trustees must ensure compliance to avoid penalties and maintain the trust’s integrity.

How are Irrevocable Trusts Taxed?

The way an irrevocable trust is taxed depends on its classification. The IRS treats grantor and non-grantor trusts differently.

Grantor Trusts

In a grantor trust, the person who created the trust (the grantor) retains certain powers. As a result, the trust’s income is reported on the grantor’s personal tax return. The trust itself typically does not pay income taxes or file a separate return.

Non-Grantor Trusts

A non-grantor trust is its own taxable entity. The trustee files Form 1041 and reports any income earned. If the trust distributes income to beneficiaries, it must issue Schedule K-1 forms. Beneficiaries report the income on their own returns. Any income retained by the trust is taxed at trust rates, which are typically higher than individual rates.

Tax Considerations for Beneficiaries

If you are a beneficiary, your tax responsibility depends on what you receive. Overall:

- You will not pay tax on distributions from the trust’s principal.

- If you receive income, such as interest or dividends, that amount is taxable to you.

Capital Gains Considerations

If your trust sells appreciated assets, such as real estate or stocks, capital gains taxes will apply. Here is how it works:

- In a non-grantor trust, the trust pays the tax.

- In a grantor trust, you, as the grantor, may be responsible.

Also, some trusts do not receive a step-up in basis at death, which can lead to higher taxes for your beneficiaries.

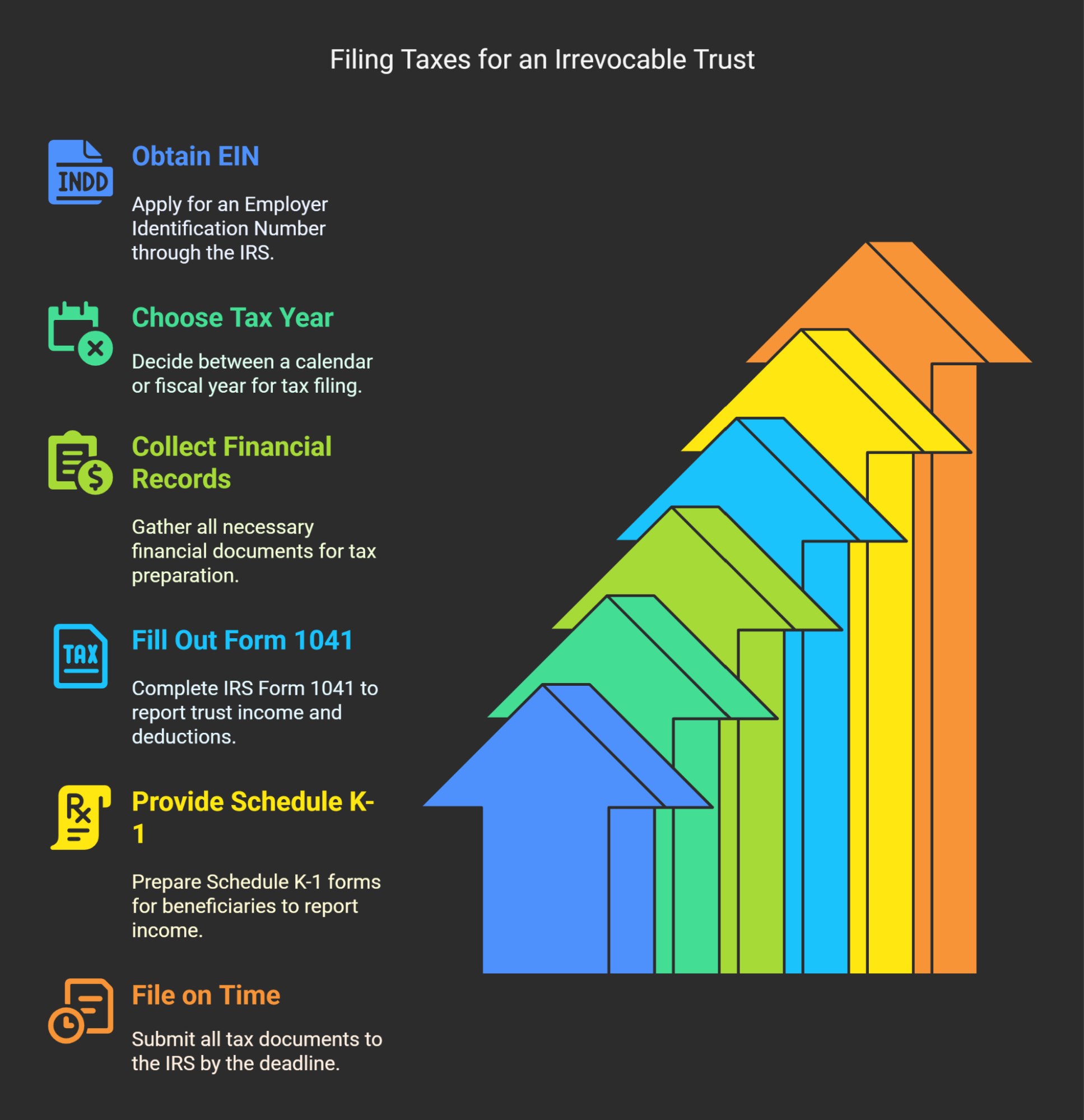

How to File Taxes for an Irrevocable Trust

Get an EIN

Every irrevocable trust must have its own Employer Identification Number (EIN). You can apply through the IRS website or by submitting Form SS-4. This number identifies the trust for tax purposes.

Choose the Tax Year

Decide whether the trust will follow a calendar year (ending December 31) or a fiscal year. This choice determines your filing deadline.

Collect Financial Records

You will need detailed records of all income earned by the trust (such as interest, dividends, and capital gains), as well as deductions and any distributions to beneficiaries.

Fill Out Form 1041

Use IRS Form 1041 to report the trust’s income, deductions, and distributions. Accuracy is critical. Mistakes can lead to penalties or delays.

Provide Schedule K-1 to Beneficiaries

If the trust distributes income to beneficiaries, prepare a Schedule K-1 for each one. This form shows the amount of taxable income they must report individually.

File on Time

Submit Form 1041 and the accompanying Schedules K-1 to the IRS by the appropriate deadline:

- Calendar Year Trusts: April 15 of the following year.

- Fiscal Year Trusts: The 15th day of the fourth month after the end of the trust’s fiscal year.

If you need additional time, file Form 7004 to request an automatic extension.

Advantages of Offshore Irrevocable Trusts

- Stronger Asset Protection: Offshore jurisdictions like the Cook Islands, Nevis, and Belize offer stronger legal protections against domestic lawsuits and judgments.

- Legal Separation: Assets placed in an offshore trust are held outside U.S. court jurisdiction, creating a significant legal barrier for creditors.

- Preserving Financial Privacy: Offshore trusts reduce public disclosure and reporting requirements, helping maintain confidentiality.

- Tax-Neutral Structures: When structured properly, offshore trusts are tax-compliant and do not trigger additional taxes solely due to location.

- Holding Diverse Assets: Offshore trusts can hold cryptocurrency, real estate, and international investments with greater flexibility.

Protect Your Assets Offshore with Blake Harris Law

While domestic trusts offer some protection, offshore irrevocable trusts deliver enhanced privacy, stronger legal barriers, and greater control, especially for clients with substantial assets or higher legal exposure.

At Blake Harris Law, we help clients safeguard their wealth through tax-efficient irrevocable trusts tailored for long-term protection.

We manage every step of the trust process, working with trusted jurisdictions including the Cook Islands, Nevis, and Belize. Our team ensures full legal compliance while building a structure that fits your specific goals.

Contact us today to safeguard your wealth.