Quick Summary

This article outlines eight effective strategies to protect assets in Texas, including establishing offshore trusts in the Cook Islands, Nevis, and Belize; forming LLCs and DAPTs; leveraging domestic retirement accounts; safeguarding cryptocurrency; diversifying investments; implementing estate planning; and purchasing insurance to shield wealth from legal risks and financial threats.

Worried About Losing Your Wealth in Texas?

For business owners, real estate investors, and high-net-worth individuals in Texas, the threat of lawsuits, divorce, or creditor claims is real.

Imagine building your life savings, growing your investments, or running a thriving business, only to have legal challenges put it all at risk. Many Texans face this vulnerability without realizing there are proactive strategies to shield their wealth.

In this Blake Harris Law article, we cover 8 strategies to protect your assets in Texas, from trusts to cryptocurrency, helping you preserve wealth and maintain privacy.

But first…

Why Listen to Us?

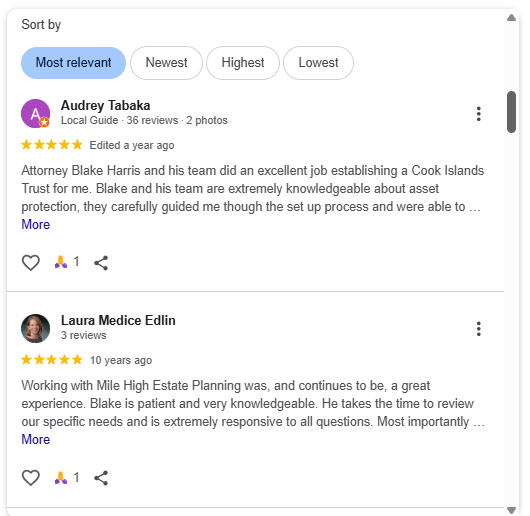

At Blake Harris Law, we focus exclusively on offshore asset protection, helping hundreds of high-net-worth clients safeguard real estate, businesses, and cryptocurrency. With decades of combined experience, a global network spanning the Cook Islands, Nevis, and Belize, and over 75 five-star Google reviews, we understand how to protect wealth from legal threats. This perspective allows us to share proven strategies for preserving assets in Texas with clarity and confidence.

What Does It Mean to Protect Your Assets in Texas?

Protecting your assets in Texas means taking legal, ethical steps to shield your wealth from potential claims, lawsuits, or other financial threats. It is about structuring your property, investments, business interests, and even cryptocurrency so that they remain secure and confidential.

Asset protection does not involve hiding or avoiding legal obligations; instead, it focuses on preserving your financial privacy, limiting legal exposure, and ensuring that your hard-earned wealth is safeguarded for you and your family.

Why Asset Protection Matters in Texas

- Shield Your Wealth from Legal Threats: Lawsuits and creditor claims can put your financial security at risk, making legal protection essential to keep your wealth intact.

- Safeguard Your Business Interests: Texas is a litigious state. Asset protection structures prevent potential legal actions from affecting your business assets.

- Protect Family Assets in Divorce: Texas is a community property state, meaning assets acquired during marriage can be subject to division. Proper planning ensures your personal wealth, including investments and property, remains secure.

- Protect Real Estate Holdings: Texas property owners face unique risks from liens, lawsuits, and other claims. Asset protection strategies help safeguard your real estate investments and ensure your property remains secure.

- Ensure Long-Term Financial Stability: By protecting your assets now, you ensure your wealth is preserved and can benefit future generations.

8 Proven Strategies to Protect Your Assets in Texas

1. Establish an Offshore Trust

One of the most effective legal methods to protect assets in Texas is to establish an offshore trust. This involves creating a trust in a jurisdiction outside the United States, such as the Cook Islands, Nevis, and Belize, which are well-known for strong asset protection laws.

Offshore trusts are designed to keep your assets out of public view and shield them from potential claims while complying fully with legal and tax obligations.

Here is how an offshore trust works to protect your wealth:

- Ownership Transfer: You transfer ownership of your assets, such as real estate, business interests, or cryptocurrency, to the offshore trust. The trust becomes the legal owner, but you retain beneficial rights.

- Confidentiality: Offshore jurisdictions offer strict privacy protections, making it difficult for potential claimants to access trust details or locate assets.

- Legal Barriers: Many offshore trusts are structured with built-in protections that limit a creditor’s ability to challenge the trust or force asset liquidation. These include high burdens of proof and limited jurisdictional reach.

- Ongoing Compliance: Even though the trust is offshore, it adheres to all legal rules. This means all required reports and taxes are filed properly to stay fully compliant and avoid any penalties.

Clients rely on Blake Harris Law to create offshore trusts in the Cook Islands, Nevis, and Belize that are tailored to their specific needs. Each trust is carefully structured to achieve asset protection goals while ensuring full legal and tax compliance.

Wondering if you can set up a trust without an attorney? Here’s our honest answer.

2. Form an LLC, Limited Partnership, or Nevis LLC

Forming a Limited Liability Company (LLC), Limited Partnership (LP), or Nevis LLC is a practical way to separate personal wealth from business risks.

An LLC functions as a distinct legal entity. Its debts and legal obligations belong to the company, not its members. In most cases, creditors can only reach the LLC’s own assets, leaving personal property protected.

See our full guide to using LLC for asset protection.

An LP includes at least one general partner, who manages the business and assumes personal liability, along with one or more limited partners. Limited partners contribute capital but do not participate in daily management, keeping their liability limited to their investment.

A Nevis LLC, established offshore in the Nevis jurisdiction, provides an additional layer of protection compared to a standard domestic LLC. It is particularly effective for high-net-worth individuals seeking strong legal shields and confidentiality, while remaining fully compliant with U.S. law.

Key Benefits for Texas Residents:

- Creates a legal barrier between personal and business assets.

- Protects personal holdings if the business faces lawsuits, debts, or other liabilities.

- Preserves financial stability and peace of mind.

At Blake Harris Law, we work closely with business owners to ensure their LLCs, LPs, and Nevis LLCs are strategically structured. This includes:

- Choosing the right structure for your goals

- Drafting agreements that clearly define roles and responsibilities

- Ensuring proper asset titling so the liability shield remains intact

3. Use Domestic Asset Protection Trusts (DAPTs)

If you face lawsuits, business disputes, or personal liabilities in Texas, a Domestic Asset Protection Trust (DAPT) can help safeguard your wealth.

A DAPT is a legal tool that allows you to place assets, such as real estate, investments, or cryptocurrency, into a trust governed by favorable state laws.

How DAPT Works

- Beneficiary Rights: You can create the trust and still receive distributions as a beneficiary.

- Asset Protection: Assets in the trust are generally beyond the reach of most creditors.

- Proactive Planning: The trust must be established and funded before any legal issues arise to ensure strong protection.

Proper structuring ensures the DAPT is recognized under state law, providing robust protection while maintaining full compliance. This makes DAPTs a proactive, lawful strategy for preserving wealth over the long term.

4. Implement Proper Estate Planning

If you want to ensure your assets are protected and distributed according to your wishes, proper estate planning is essential. It involves creating a clear, legally binding plan that outlines how your asset will be managed, protected, and passed on during your lifetime and even beyond.

Key Components of Estate Planning

- Creating a Will: Designate beneficiaries clearly to ensure your assets are distributed as intended.

- Using Trusts: Trusts provide an extra layer of protection, shielding assets from legal threats and avoiding unnecessary court processes.

- Durable Powers of Attorney: Set up powers of attorney for healthcare and finances to maintain control and protection in unforeseen situations.

Working with an asset protection attorney ensures your estate plan is structured effectively. They help reduce exposure to lawsuits and creditors while ensuring compliance with state and federal laws.

5. Diversifying Your Investment Portfolio

If one investment faces a downturn or legal challenge in Texas, it should not jeopardize your entire financial position. Diversifying your portfolio spreads risk across multiple assets, reducing vulnerability and protecting your wealth.

See our guide to asset protection in high-risk investments.

What Portfolio Investment Diversification Looks Like:

- Asset Classes: Stocks, bonds, real estate, commodities, and alternative assets such as cryptocurrency.

- Legal Structures: Holding assets in different structures, like trusts or LLCs, adds layers of legal protection.

A well-diversified strategy helps offset losses in one area with gains in another, while also providing potential for steady, long-term growth. By combining smart asset allocation with protective legal structures, you create a more resilient financial position, shielding your wealth from both market volatility and potential claims.

6. Protect Cryptocurrency with Specialized Structures

Cryptocurrency is a valuable and often volatile asset, making proper protection essential. Unlike traditional assets, digital currencies are decentralized and can be difficult to safeguard through conventional methods.

Effective Strategies for Crypto Protection:

- Offshore Trusts: Transferring cryptocurrency into a Cook Islands, Nevis, or Belize trust shields assets from potential legal claims, as the trust becomes the legal owner while you retain beneficial rights.

- LLCs: Holding crypto under a Texas or offshore LLC separates digital assets from personal wealth and provides liability protection.

- Multi-Signature Wallets: Require multiple approvals for transactions, adding an extra layer of security against unauthorized access or theft.

At Blake Harris Law, we help clients navigate the legal and regulatory considerations around cryptocurrency. Our team ensures that protection strategies comply with all applicable laws while maximizing privacy and safeguarding digital assets.

7. Leverage Domestic Retirement Accounts

Domestic retirement accounts, such as IRAs and 401(k)s, can provide significant protection for your assets in Texas. These accounts are often shielded from creditors under federal and state laws, making them a valuable component of an asset protection strategy.

Key Considerations When Setting up Domestic Retirement Accounts:

- Legal Protection: Many retirement accounts are protected from lawsuits and creditor claims, helping preserve your long-term wealth.

- Tax Advantages: Contributions to certain accounts may offer tax benefits, supporting both growth and security.

- Diversification: Including retirement accounts alongside other investments adds another layer of protection, ensuring that a single financial setback does not threaten your overall portfolio.

Properly leveraging domestic retirement accounts allows you to safeguard a portion of your wealth while maintaining compliance with legal and financial regulations.

8. Purchase Appropriate Insurance Policies

Insurance is a critical tool for protecting your assets from unexpected risks. The right coverage provides financial security and peace of mind while shielding you from potential claims, damages, or liabilities.

Key Types of Insurance:

- Homeowners Insurance: Protects your property and personal belongings from damage, theft, or natural disasters.

- Business Liability Insurance: Covers legal claims arising from business operations, helping safeguard both personal and business assets.

- Umbrella Insurance: Adds an extra layer of coverage beyond standard policies, protecting you from large claims or lawsuits that could threaten your wealth.

- Auto Insurance: Essential for protecting your vehicle, including coverage for damages, theft, and liability in accidents.

Speaking of auto insurance, here is how to protect your assets after a car accident.

Safeguard Your Texas Assets with Blake Harris Law

Protecting your wealth in Texas requires more than planning; it demands legally sound strategies that can only be curated by experienced asset protection attorneys.

That’s where we come in. At Blake Harris Law, we develop customized, legally compliant strategies designed to shield your assets from lawsuits, creditors, and other risks. Whether through Cook Islands, Nevis, or Belize trusts, offshore structures, or domestic planning, we ensure your wealth is protected while preserving financial privacy.

Contact Blake Harris Law today and take the first step toward securing your assets for the long term.