Quick Summary

This article provides an in-depth review of Delaware Asset Protection Trusts, highlighting the key features, benefits, and pricing. It explains why these trusts are crucial for high-net-worth individuals seeking to protect their assets. Explore the pros and cons, compare alternatives, and consider your next steps. For further guidance, visit our blog for more insights on asset protection strategies.

Why Delaware Asset Protection Trust is Worth Considering

Delaware is one of the few states offering a standard asset protection trust (APT) structure that allows individuals to protect their assets from creditors, lawsuits, and other potential threats. With its favorable legal framework, the Delaware Asset Protection Trust provides a unique solution for high-net-worth individuals looking to safeguard their wealth.

In this Blake Harris Law review, we will go into the details of the Delaware APT, its key features, pricing, benefits, and drawbacks. By the end, you will have a solid understanding of whether this trust structure is right for your needs.

Why Listen to Us?

At Blake Harris Law, we bring years of specialized experience in asset protection, helping individuals safeguard their wealth from potential legal and financial threats. Our team is deeply knowledgeable about Delaware Asset Protection Trusts (APTs) and other wealth protection strategies, including offshore trusts like those in the Cook Islands.

We have successfully guided high-net-worth individuals through the complexities of asset protection, providing customized advice based on their unique needs. Our commitment to transparency, expertise, and client satisfaction ensures that you receive the best possible solutions for securing your assets.

What Is Delaware Asset Protection Trust?

A Delaware Asset Protection Trust (APT) is a legal arrangement that allows individuals to transfer assets into a trust, shielding them from future creditors, divorce settlements, and lawsuits. For example, if facing a potential divorce, assets placed in a Delaware APT may be protected from being divided during the proceedings. Similarly, in the event of a lawsuit, the assets within the trust could be safeguarded from being seized by creditors.

The key advantage of a Delaware APT lies in the state’s laws, which provide a high level of protection for the trust creator (also known as the grantor), while allowing flexibility in how assets are managed and distributed. This trust structure is especially beneficial for individuals with significant assets, typically ranging from $3 million to $20 million, looking to protect their wealth from legal threats.

Notably, Delaware is one of the few U.S. states that allows self-settled trusts, meaning the person who creates the trust can also benefit from it. This is unlike traditional asset protection trusts where the creator cannot access the assets.

Key Features of Delaware Asset Protection Trust

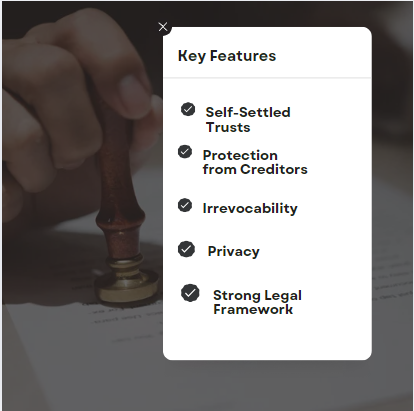

- Self-Settled Trusts: Delaware’s laws allow you to be both the creator and beneficiary of your trust, giving you flexibility and control over your wealth.

- Protection from Creditors: Once assets are transferred into a Delaware APT, they are generally shielded from creditors, lawsuits, and judgments. The trust can be used to protect assets from civil judgments or divorce settlements.

- Irrevocability: The trust is irrevocable, meaning once you establish it and transfer assets, you cannot alter or revoke the trust. This provides stronger protection against creditors.

- Privacy: Delaware offers high privacy levels for trust owners, ensuring that the details of the trust and its assets are not easily accessible to the public.

- Strong Legal Framework: Delaware’s legal system offers clarity and consistency in trust law, which enhances the protection and enforceability of your assets.

Pricing

The cost of establishing a Delaware Asset Protection Trust can vary depending on several factors, including the complexity of the assets being protected, trustee services, and legal fees involved. Generally, you can expect to pay anywhere from $2,000 to $10,000 for initial setup. Ongoing maintenance fees, including trustee services, typically range from $1,000 to $3,000 annually.

These fees are a one-time and annual investment in ensuring your assets are securely protected from potential threats.

What We Like

- Comprehensive Asset Protection: The Delaware APT provides strong protection against creditors, lawsuits, and divorce settlements. It offers one of the highest levels of asset security available in the United States.

- Flexibility: You retain control over your assets, making it easier to manage and make decisions on how your wealth is used.

- Tax Benefits: Delaware’s lack of state income taxes on trusts makes it an attractive option for individuals looking to reduce their tax burden.

- Privacy: Delaware offers excellent privacy protections, ensuring that the assets and details of your trust remain confidential.

What We Don’t Like

- Irrevocability: Once established, the Delaware APT is irrevocable. While this provides stronger asset protection, it also means you cannot change the terms or access the assets freely.

- High Setup Fees: The costs involved in setting up a Delaware Asset Protection Trust may be a barrier for some individuals, especially those with assets on the lower end of the wealth spectrum.

- Complexity: Establishing a Delaware APT requires careful legal planning and documentation, which can make the process more complex compared to simpler estate planning tools.

- Limited Control Over Trust Assets: While you retain the ability to benefit from the trust, the level of control you have over the trust assets is limited compared to personal ownership.

A Better Alternative: Cook Islands Asset Protection Trust

While Delaware offers strong asset protection, it is not the only jurisdiction offering these benefits. A strong alternative worth considering is the Cook Islands Asset Protection Trust. Known for its formidable asset protection laws, the Cook Islands is widely regarded as one of the strongest offshore jurisdictions for safeguarding wealth from legal threats.

By placing assets such as cash, investment portfolios, cryptocurrency, real estate, or other valuable holdings into a Cook Islands Trust, you can significantly reduce the risk of those assets being seized in the event of lawsuits, divorce settlements, bankruptcy, or other legal challenges in your home country. Unlike domestic trusts, the Cook Islands provides a level of protection that is difficult for creditors or claimants to breach.

Additionally, while the trust offers extensive protection, you retain control over your assets. With the help of a trusted Cook Islands trustee, you can still receive distributions, direct investments, and manage your wealth as you see fit. Many individuals turn to Blake Harris Law for professional guidance in establishing these powerful trusts.

As Kendall Mills, a Jacksonville, FL attorney, says, “I started working with Attorney Blake Harris in 2017. Blake is one of the most knowledgeable and trustworthy asset protection attorneys I have known in my 20+ years of being an attorney. If you are looking to protect your assets or considering setting up a Cook Islands Trust, I highly recommend you contact Blake.”

Key Features of Cook Islands Asset Protection Trust

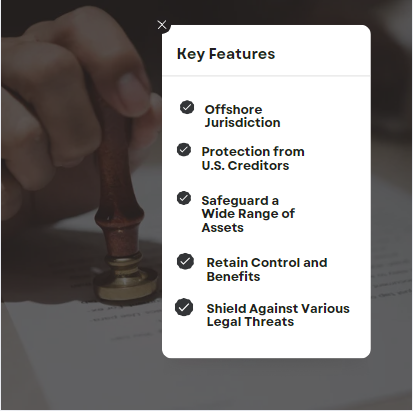

- Offshore Jurisdiction: The Cook Islands offer strong asset protection laws that make it incredibly difficult for creditors to access the trust’s assets.

- Protection from U.S. Creditors: The Cook Islands offer extensive protection from the U.S.-based creditors, making it a powerful tool for high-net-worth individuals concerned about lawsuits or judgments in the U.S.

- Safeguard a Wide Range of Assets: The Cook Islands trust can protect various types of assets, including cash, investment portfolios, real estate, cryptocurrency, and more, ensuring comprehensive protection for your wealth.

- Retain Control and Benefits: While the trust offers strong protection, you still retain control over your assets. You can receive distributions, direct investments, and manage your wealth with the help of your Cook Islands trustee.

- Shield Against Various Legal Threats: The Cook Islands trust protects assets from numerous legal challenges, including lawsuits, bankruptcy, business disputes, and malpractice claims, making it a comprehensive solution for asset protection.

Pricing for Cook Islands Asset Protection Trust

Setting up a Cook Islands trust typically costs between $15,000 and $30,000, depending on complexity and assets involved. While more expensive than a Delaware APT, the Cook Islands trust offers stronger creditor protection.

In comparison, an offshore trust usually costs $25,000 to $50,000 to set up, with annual fees between $5,000 and $10,000. However, at Blake Harris Law, our longstanding relationships with Cook Islands service providers allow us to offer competitive pricing and affordable annual fees for trust formation.

Why Choose Cook Islands Asset Protection Trust?

- Stronger Legal Protections: The Cook Islands have a reputation for offering some of the most robust asset protection laws in the world. This can provide additional security for high-net-worth individuals looking for maximum protection.

- Global Coverage: The Cook Islands trust can offer protection not just in the U.S. but in other jurisdictions as well, giving it an edge over Delaware when it comes to international asset protection.

- Immunity from Domestic Creditors: Creditors in the U.S. or other jurisdictions have a difficult time accessing assets placed in the Cook Islands, making it a strong choice for those facing potential legal threats.

Take Control of Your Wealth Protection Today

When it comes to protecting your wealth from legal threats, a Cook Islands Asset Protection Trust offers unparalleled security and peace of mind. While other jurisdictions like Delaware provide solid protection, the Cook Islands stand out with their superior legal framework and stronger creditor defenses.

At Blake Harris Law, we specialize in setting up these trusts with competitive pricing and affordable annual fees. With our experience and trusted relationships, we ensure your wealth is safeguarded.

Contact Blake Harris Law today to explore how a Cook Islands trust can protect your assets and secure your future!