Quick Summary

Does a sole proprietorship protect personal assets? No. Since you and your business are the same legal entity, creditors can target your home, savings, or cryptocurrency. This article explains the risks and explores stronger alternatives, like LLCs and trusts, that provide real protection. Visit our blog for more insights and guides on safeguarding your wealth.

Does a Sole Proprietorship Really Protect Your Personal Assets?

Imagine spending years building a thriving business, only to have it all jeopardized by a single lawsuit. This is a reality many entrepreneurs face when operating as sole proprietors.

Physicians, real estate investors, and business owners with growing net worths often assume their hard work is shielded from legal threats, only to discover too late that their personal bank accounts, homes, and even retirement savings are fully exposed.

In this Blake Harris Law article, we are going to explain why a sole proprietorship offers little to no asset protection, what risks you could be facing right now, and what stronger legal structures high-net-worth individuals should consider to secure their wealth.

But first…

Why Listen to Us?

At Blake Harris Law, asset protection is our core focus. We have helped clients across the U.S. and beyond safeguard millions in real estate, cryptocurrency, and other high-value assets through Cook Islands Trusts, Belize Trusts, and Nevis LLCs.

Our hands-on experience shows us what actually works and what leaves assets vulnerable. If you want proven strategies that go beyond basic business setups, we know how to structure lasting protection.

What Is a Sole Proprietorship?

A sole proprietorship is an unincorporated business structure owned and operated by one individual. It requires no formal registration, separate legal entity, or complex paperwork beyond necessary licenses.

This structure appeals to freelancers, consultants, and small business owners because it is easy to establish and manage.

Does a Sole Proprietorship Protect Personal Assets?

The short answer is NO.

A sole proprietorship does not create a legal distinction between you and your business. This means you are personally liable for everything the business does, including debts, lawsuits, or legal claims. This is known as unlimited liability. If someone sues your business and wins, they can legally go after your personal assets to satisfy the judgment.

What Makes Sole Proprietorships Risky for High-Net-Worth Individuals?

If you have accumulated significant wealth, operating as a sole proprietor puts far more than just your business income at risk. With no legal separation between your business and personal assets, everything you own can be vulnerable to a single lawsuit or debt claim.

High Visibility = High Risk

The more successful you become, the more likely you are to attract legal attention, whether legitimate or opportunistic. High-net-worth individuals are often seen as targets, especially in professions where liability is common.

For example:

- If you own a private medical practice and a malpractice suit is filed, the judgment could extend beyond your business income to your personal home and retirement accounts.

- If you run a thriving online brand and are accused of copyright infringement, your personal savings and cryptocurrency portfolio could be seized in a court-ordered judgment.

At Blake Harris Law, we have seen firsthand how these situations unfold. Clients come to us after facing major threats to their wealth simply because their business structure failed to shield them.

Assets That May Be at Risk Include:

- Real estate (including personal residences and investment properties)

- Bank and brokerage accounts

- Retirement accounts

- Luxury vehicles

- Cryptocurrency holdings (increasingly subject to legal scrutiny)

No Firewall Between Business and Personal Wealth

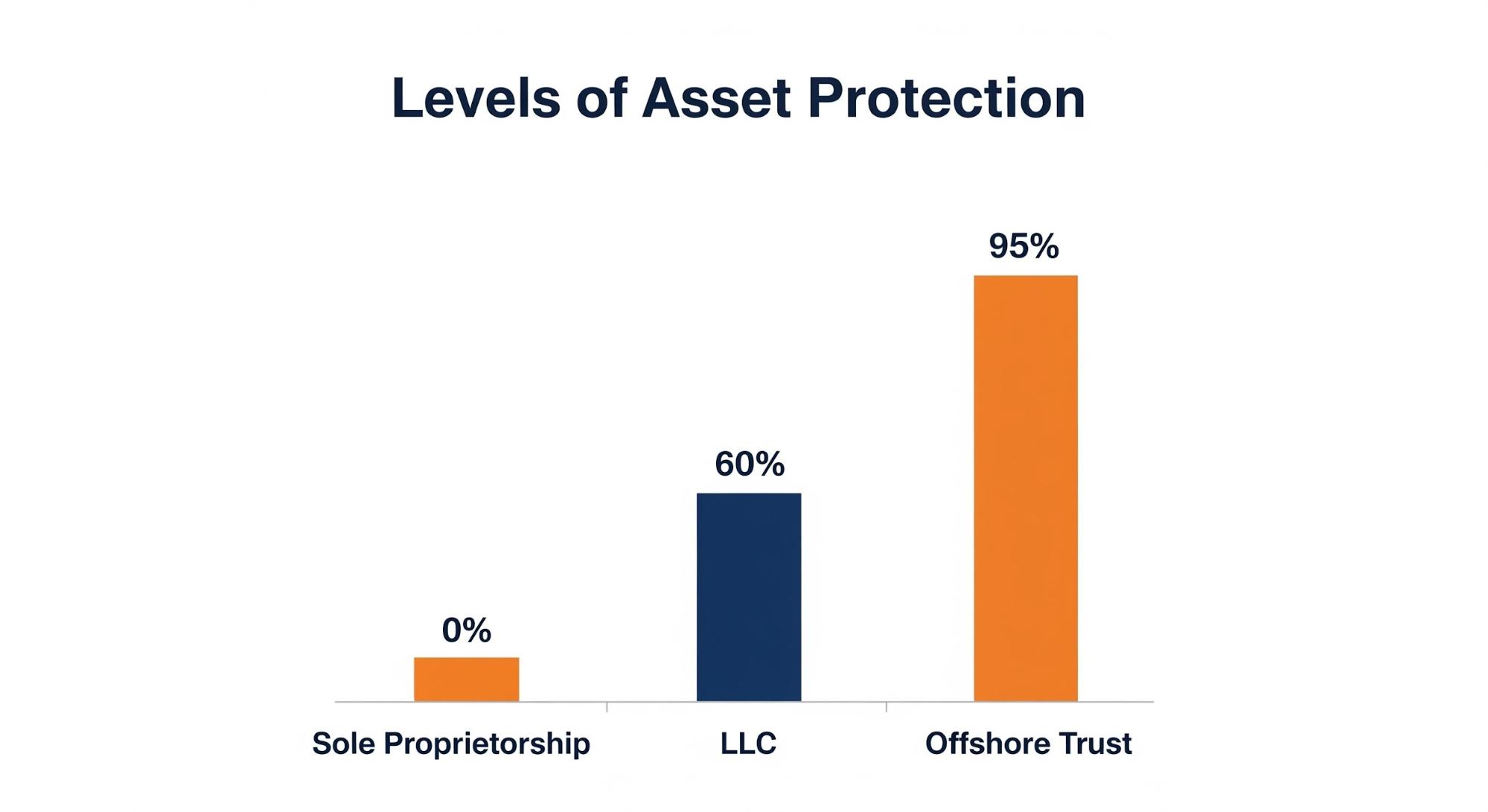

Unlike LLCs or trusts, sole proprietorships offer no liability protection. A business lawsuit is a personal lawsuit. Without strong asset protection, your financial security and legacy are exposed.

For high-net-worth individuals, protecting your assets is not optional. At Blake Harris Law, we help clients implement proven legal structures that create distance between business risk and personal wealth.

Effective Personal Asset Protection Strategies for Sole Proprietors

As an entrepreneur, there are legal strategies available that can reduce your exposure to lawsuits and protect your personal wealth. Below are the most effective strategies used by successful professionals to shield assets from potential threats.

Limited Liability Companies (LLCs)

An LLC creates a legal boundary between personal wealth and business operations. When properly maintained, it helps reduce your exposure to lawsuits or business debt.

Protection Requirements:

- Keep personal and business finances separate

- Maintain a formal operating agreement

- Avoid personally guaranteeing business debts

LLCs are relatively simple to form and offer flexible tax options (as sole proprietorships, partnerships, or S corporations). However, this structure is not foolproof. Courts can pierce the corporate veil if formalities are ignored or the LLC is misused. Personal guarantees still create exposure.

Best Use Case: Business owners in low-risk industries seeking basic liability protection with administrative simplicity.

Domestic Asset Protection Trusts

Some U.S. states allow self-settled asset protection trusts, where you transfer assets while potentially remaining a beneficiary. These trusts protect assets from future creditors when structured correctly.

Blake Harris Law offers a proprietary Titanium Trust designed for clients who prefer United States-based solutions. This structure protects cash, securities, real estate, and cryptocurrency while providing offshore transfer options if needed.

Key advantages include:

- Legally separating assets from personal ownership

- Shielding wealth from certain types of judgments or claims

- Maintaining access to trust distributions, depending on state law

- Providing quick offshore conversion capability if needed

The Titanium Trust is one such structure that balances onshore accessibility with strong protective features. However, the trust’s effectiveness depends on choosing a favorable state and adhering to strict legal standards.

Best Use Case: Individuals seeking United States-based solutions to preserve financial privacy while maintaining some access and control.

Offshore Trusts

International asset protection through offshore trusts in jurisdictions in the Cook Islands, Belize, or Nevis provides the strongest available protection.

Cook Islands Trust

- Cook Islands courts ignore foreign judgments.

- Protected by asset protection laws since 1984.

- One-year statute of limitations for fraudulent transfer claims.

- Protects real estate, businesses, investments, and cryptocurrency.

Belize Trust

- Provides immediate creditor protection upon asset transfer.

- Offers fast establishment with strong confidentiality.

- Features a flexible structure for various asset types.

Nevis Trust/ LLC

- Nevis Laws favor asset protection over creditor claims.

- Combines business functionality with wealth protection.

- Creates strong legal barriers against collection efforts.

Best Use Case: High-net-worth individuals seeking advanced asset protection. This structure helps shield assets from potential claims, maintain long-term financial privacy, and build a strong legal defense against litigation. Ideal for those with cryptocurrency or in high-risk professions.

Which Personal Asset Protection Strategy is Right for You?

Each structure offers different strengths depending on your financial situation, risk profile, and the types of assets you want to protect. This comparison helps evaluate your options:

| Structure | Protection Strength | Control Retained | Best For |

| LLC (Domestic) | Moderate | Full | Low-risk business owners |

| Domestic APT (e.g., Titanium Trust) | Strong (state-dependent) | Partial | Onshore asset protection with moderate exposure |

| Offshore Trust | Highest | Minimal | High-net-worth individuals facing substantial legal risk |

| Nevis Trust/LLC | Strong | Varies | Asset protection with business functionality |

While LLCs and domestic trusts provide some level of protection, offshore trusts remain the most effective solution for individuals who want to legally shield their assets from future claims.

With strong privacy laws, court-tested durability, and international enforcement barriers, Cook Islands, Belize, and Nevis trusts offer the highest level of asset security available today.

Take the Next Steps to Protect Your Personal Assets

Does a sole proprietorship protect personal assets? Absolutely not. Every day you operate without proper protection, your wealth faces unnecessary risk. Lawsuits and claims can reach your assets. To prevent this, you need a legal structure and the right legal guidance.

Blake Harris Law specializes in asset protection. We help high-net-worth individuals safeguard their assets, like real estate, cryptocurrency, and investment portfolios, through proven legal strategies. With a team of experienced asset protection attorneys, our services include:

- Custom legal strategies based on your assets, goals, and risk profile

- Trust structures, including Cook Islands Trusts, Belize Trusts, and Nevis LLCs

- Protection for modern assets, including cryptocurrency, business interests, and real estate

- Flat-fee pricing with clear, transparent engagement terms

- End-to-end support, from initial consultation to ongoing trust maintenance

If you are serious about protecting your wealth, the first step is speaking with a qualified attorney. Schedule a confidential consultation with Blake Harris Law to get started.