Offshore asset protection involves establishing assets, like trusts, LLCs, or foundations, in a foreign jurisdiction for enhanced protection and privacy against creditors, lawsuits, and more. Using multiple offshore jurisdictions for asset protection can strengthen your strategy, allowing you to rely on the favorable protection laws of various countries. A multi-jurisdictional strategy that includes the services of an offshore asset protection attorney minimizes risks similar to portfolio diversification.

While this type of asset protection can provide ample benefits, it does require careful thought as you must navigate complex tax considerations and numerous regulatory structures. Whether you’re concerned about a lawsuit, navigating a divorce, or simply want to protect your hard-earned assets, keep reading to learn more about asset protection with multiple foreign jurisdictions.

What Is Offshore Asset Protection?

You must understand the basics of offshore asset protection before delving into highly complex multi-jurisdictional strategies. Offshore asset protection is a legal strategy to shield assets from various actions in the United States. To establish your assets offshore, you must create a legal entity like a trust or LLC that places the items under the jurisdiction’s protection.

Offshore asset protection can help individuals shield their assets from lawsuits, divorce battles, bankruptcy seizures, debt collectors, and more. Many foreign jurisdictions have strict laws preventing U.S. creditors from accessing assets in foreign trusts, and any attempt to do so would cost the creditor large sums of money, typically warding off such efforts.

High-net-worth individuals or those working in high-risk professions often establish offshore asset strategies to protect their wealth from lawsuits. For example, if you work as a physician, you have a 31.2% chance of being sued in your professional career. You would likely want to avoid the risks that come with this frightening statistic by moving your assets overseas, where they would remain protected from seizure in a lawsuit.

Benefits of Using Multiple Offshore Jurisdictions

Using multiple offshore jurisdictions for asset protection provides extra layers of security, making it more difficult for legal challenges or economic instability to affect the assets. With a multi-jurisdictional strategy, you can enjoy the following benefits:

Minimization of Political and Economic Risks

Say you create your offshore trust in a highly secure jurisdiction, but another force colonizes it a few years later. After this major political shift, the nation adjusts its protection policies, leaving your assets exposed to U.S. creditors. While you can try hard to select more politically stable jurisdictions, you cannot always predict the future.

By placing assets in different jurisdictions, you can minimize political and economic risks. If one jurisdiction suffers an economic collapse or becomes involved in a war, you can rest easy knowing you didn’t place all of your eggs in this one basket.

Enhanced Privacy and Confidentiality

Offshore trusts and other structures innately offer improved privacy, but creditors, ex-business partners, and anyone else can still find your information with enough hard work. By spreading your assets across jurisdictions, you multiply your privacy and confidentiality, as each jurisdiction will have its own legal frameworks in place to shield your information from the public eye.

Protection Through Legal Separation

The legal separation of assets across jurisdictions offers enhanced protection against creditors. Creditors face extremely challenging laws and financial barriers when using multiple offshore jurisdictions for asset protection. Legal separation can help you enjoy added protection in many legal scenarios.

Legal Entities for Offshore Asset Protection

To structure a solid multi-offshore jurisdiction plan, you need to understand the types of legal entities you can create. Here are the primary options:

Offshore Trusts

With an offshore trust, you transfer assets into a legal entity established overseas for protection under a foreign legal system. As the trust’s creator (the settlor), you cannot manage the assets, so you must name a non-U.S. citizen trustee to manage and distribute them on your behalf. A popular option is a self-settled offshore trust, where you name yourself as the primary beneficiary of the assets.

Offshore trusts can offer various tax advantages and excellent wealth protection, as the assets inside the trust are often barred from creditor collection, depending on the jurisdiction you select. An offshore trust can own many assets, including the following:

- Cash

- Stocks

- Bonds

- Cryptocurrency

- Businesses

- Intellectual property

- Investment portfolios

- Precious metals

- Real estate

Offshore LLCs

With an offshore limited liability company (LLC), you establish a legal entity in a foreign jurisdiction for added asset protection. While LLCs already provide a layer of asset protection by removing owner liability from company debts or lawsuits, domestic LLCs cannot protect your wealth in all situations. Offshore LLCs add an extra layer of privacy, protection, and security as the foreign jurisdiction’s laws can prevent U.S. creditor actions.

Offshore LLCs can also offer various tax advantages. You can use LLCs to structure joint venture arrangements across jurisdictions as well.

Foundations

An offshore foundation is another flexible legal entity that can serve diverse purposes, including personal asset protection. Foundations are tax-exempt organizations that do not act as their own charities but instead make donations to other charities. With this versatile structure, you can safeguard your assets overseas while enjoying more customizable management requirements.

How To Structure a Multi-Jurisdiction Asset Protection Plan

If you’re interested in using multiple offshore jurisdictions for asset protection, you must structure your strategy properly to ensure effectiveness.

Professional advisors can help you navigate cross-border compliance and reporting requirements, ensuring the legal establishment of all entities. For optimal protection, you must keep assets separate across different jurisdictions.

While you could create multiple trusts, we recommend developing a multi-layered protection system that leverages various legal entities. By combining trusts, LLCs, and foundations in your multi-jurisdiction asset protection strategy, you can enjoy protection in diverse situations while taking advantage of tax efficiency benefits.

For example, you could establish a trust in the Cook Islands containing your cryptocurrencies, stocks, bonds, and other investment vehicles. Then, you might open an LLC in Nevis to protect your intellectual property, business assets, and real estate. Finally, you could establish a foundation in Panama that donates cash to various charitable organizations while protecting your cash wealth from legal action.

Managing Assets Across Multiple Jurisdictions

Proper offshore entity management protects your assets and allows you to maintain control even when your wealth is spread across multiple foreign locations. When leveraging entities like a trust or LLC, you cannot simply log into a digital bank account and transfer items around. You must work with a trusted team who can oversee your assets and ensure your protection plan is followed:

- Trustees: The trustee is your designated trust administrator with the fiduciary duty to maintain the account and distribute assets according to your wishes.

- Trust protectors: A trust protector can oversee the proper execution of the trust, protecting your interests. A wealth protection attorney, for example, may act as your trust protector, leveraging their knowledge in foreign jurisdictions.

- LLC managers: The LLC manager runs the company’s day-to-day operations. Unless you plan to do so yourself, you must appoint a trustworthy manager to make financial and legal decisions for the company, compensate employees, appoint managers, etc.

If you want to retain control over your offshore assets while benefiting from wealth protection, you must select your team wisely. Conduct careful due diligence and work with trusted advisors to ensure you understand all the legal entities you create.

For example, if you establish a trust in one location and an LLC in another, you may want to work with an attorney and tax advisor in the U.S. to help you oversee the proper management and reporting of both entities.

Popular Offshore Jurisdictions for Asset Protection

Selecting the right foreign locations is vital in successfully leveraging multiple offshore jurisdictions for asset protection. Here are some popular options:

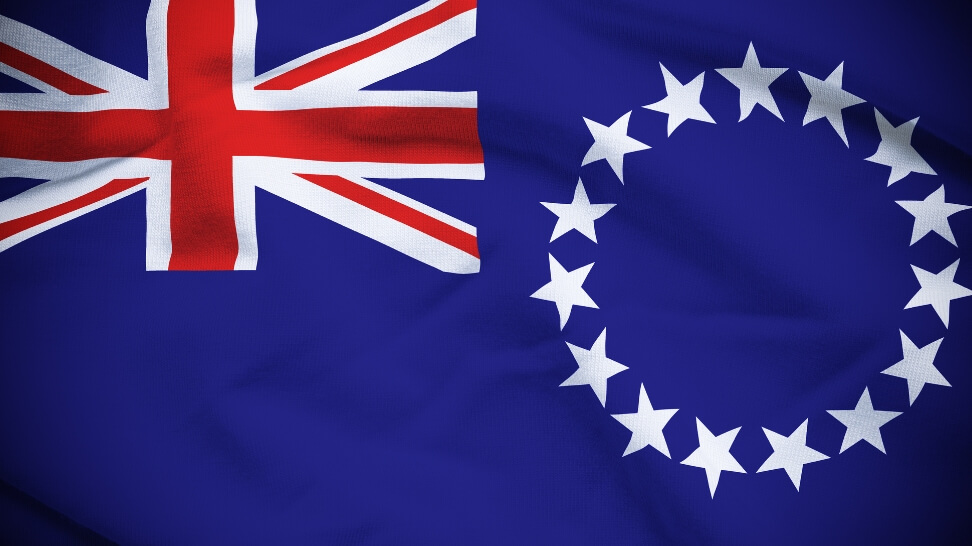

- The Cook Islands: Cook Islands courts do not recognize any foreign judgments, meaning a creditor cannot claim wealth in your Cook Islands trust if you establish it correctly. The jurisdiction also provides flexibility when establishing legal entities and tax efficiency.

- Nevis: Nevis offers premier protection against domestic creditors with privacy protection laws like the Confidential Relationships Act, plus court orders preventing foreign countries from exercising jurisdiction over trusts.

- Belize: Belize offers immediate asset protection when creating a trust, with a faster formation process than many jurisdictions. The jurisdiction also enforces strict confidentiality laws, helping to protect your privacy and wealth.

- Panama: Panama offers favorable policies for foreign entrepreneurs, efficient tax laws for foundations and LLCs, and enhanced creditor protection.

- Liechtenstein: Liechtenstein offers flexible foreign entity management policies, particularly for foundations, allowing the founder to maintain control over the entity.

Many jurisdictions can offer favorable policies, making it challenging to select the right one for your needs. You can work with a legal advisor who will analyze your particular risks, assets, and potential strategy to help you select the right jurisdictions for each entity.

Common Mistakes To Avoid in Multi-Jurisdictional Asset Protection

Using multiple offshore jurisdictions for asset protection can still be risky, as simple mistakes can void entity legality or compromise the strategy’s effectiveness. Avoid doing the following:

Overcomplicating the Structure

When setting up multi-jurisdiction protection, simplicity is often better. If you overcomplicate your structure, you must deal with even more reporting and compliance requirements.

Dozens of trusts and LLCs likely won’t benefit you more than a few well-executed entities across solid jurisdictions. We recommend sticking to the bare minimum for your personal risk minimization needs.

Ignoring Compliance and Reporting Obligations

You can land in serious legal trouble if you fail to comply with each jurisdiction’s requirements and U.S. reporting regulations. While your entities may be set up in other countries, the IRS still requires you to include specific information on your tax forms. A wealth protection attorney and tax advisor can help you stay compliant with all legal reporting requirements.

Relying Too Heavily on a Single Jurisdiction

While you don’t want to overcomplicate your strategy, you also don’t want to rely too much on just one jurisdiction. Diversifying across multiple foreign locations is essential for optimal protection.

Whether you should establish entities in two, three, four, or 10 jurisdictions simply depends on your personal assets and needs. We recommend meeting with an advisor for individualized guidance.

Is a Multi-Jurisdictional Strategy the Right Approach?

A multi-jurisdictional strategy may be the right approach for you if you want to protect your wealth but need a stronger safety net than what a single offshore trust can provide. By using multiple offshore jurisdictions for asset protection, you can minimize risks, enhance privacy, and enjoy protection through legal separation. With that being said, you’ll face more complex compliance and reporting requirements, so you must seek professional advice to create a sound multi-jurisdiction plan.

Contact Blake Harris Law today to speak with a wealth protection attorney about the possibility of developing a tailored multi-jurisdiction strategy for your particular needs.