When dealing with asset protection strategies, particularly involving offshore trusts, understanding the statute of limitations for fraudulent conveyance claims is crucial. The Cook Islands, known for its robust asset protection laws, offers a specific framework for such claims. This article breaks down the statute of limitations in the Cook Islands to help you navigate and plan your asset protection strategy effectively. However, please note that this is our interpretation of the relevant Act and not a guarantee of the outcome should a claim be filed in the Cook Islands. This is not legal advice but rather an explanation of the provisions within the Act.

Overview of the Statute of Limitations

The statute of limitations in the Cook Islands for fraudulent conveyance claims involves two key conditions that must be met to either challenge or defend against such claims. These conditions are designed to create a clear timeframe within which creditors can act to contest the validity of trust transfers or dispositions.

Two Interdependent Conditions

Two-Year Condition

Description: The first condition stipulates that if a trust is settled or a disposition occurs within two years from the date when the creditor’s cause of action accrued (the incident that triggered the legal action), the creditor has a specific timeframe to initiate legal proceedings.

Implication: If the trust is established or the asset is transferred within this two-year period, the creditor must act quickly to challenge the trust or disposition.

One-Year Condition

Description: The second condition requires that if the trust was settled or the disposition occurred within the two-year period specified in the first condition, the creditor must commence legal proceedings within one year from the date of the settlement, establishment, or disposition.

Implication: Even if the transfer occurred within the two-year window, the creditor has only one year from the event to bring the case to court.

In essence, for a creditor to be barred from challenging the trust or disposition, both conditions must be considered together:

- If the trust or disposition occurs after the two-year period, the creditor is barred regardless of any action taken.

- If the trust or disposition occurs before the two-year period, the creditor must then take action within one year to avoid being barred.

Both conditions are interdependent: the first condition establishes the timeframe for when the creditor can act, and the second condition outlines the requirement for the creditor to take action within that timeframe.

Clarification and Example:

In the context of the Cook Islands International Trust Act, “Settledsettled” means the establishment and creation of the trust with the assets that are part of it from that date. “Disposition” refers to the transfer of an asset to the trust after its creation. Each contribution or gift of assets from a settlor to the trust, whether made at the time the trust was created or afterward, is considered an individual settlement or disposition. The statute of limitations clock starts ticking for each individual contribution or gift when the transfer is made to the trust. This means that each asset transferred will have its own countdown against the statute of limitations.

The “two-year condition” might seem irrelevant at first glance, as the primary focus is on the one-year window following the settlement. However, it’s important to understand how these conditions work together. If a creditor files a lawsuit within one year of the trust being funded (thus fulfilling the one-year condition) but the lawsuit is based on a cause of action that is over two years old, the assets may still be protected under the Cook Islands International Trust Act. This is because the two-year condition was not fulfilled.

For example:

- A cause of action (e.g., a car accident) occurred on January 1, 2021.

- The trust was funded on January 2, 2024, which is more than two years after the cause of action.

- The creditor filed a lawsuit on February 1, 2024, within one year of the trust being funded.

Since the trust was funded after the two-year period, it would not be deemed to have been settled or established with the intent to defraud the creditor. Therefore, the assets would be protected under the Act, and the creditor would not be able to pursue those assets based on the intent to defraud, even though the one-year condition was met.

New Contributions and Statute of Limitations:

As mentioned earlier, each contribution or gift of assets from a settlor to the trust, whether from the moment the trust was created or thereafter, will be considered an individual settlement or disposition. The statute of limitations clock starts ticking for each individual contribution or gift when the transfer is made to the trust. This means that each asset transferred will have its own countdown against the statute of limitations, ensuring that the protection applies individually to each contribution.

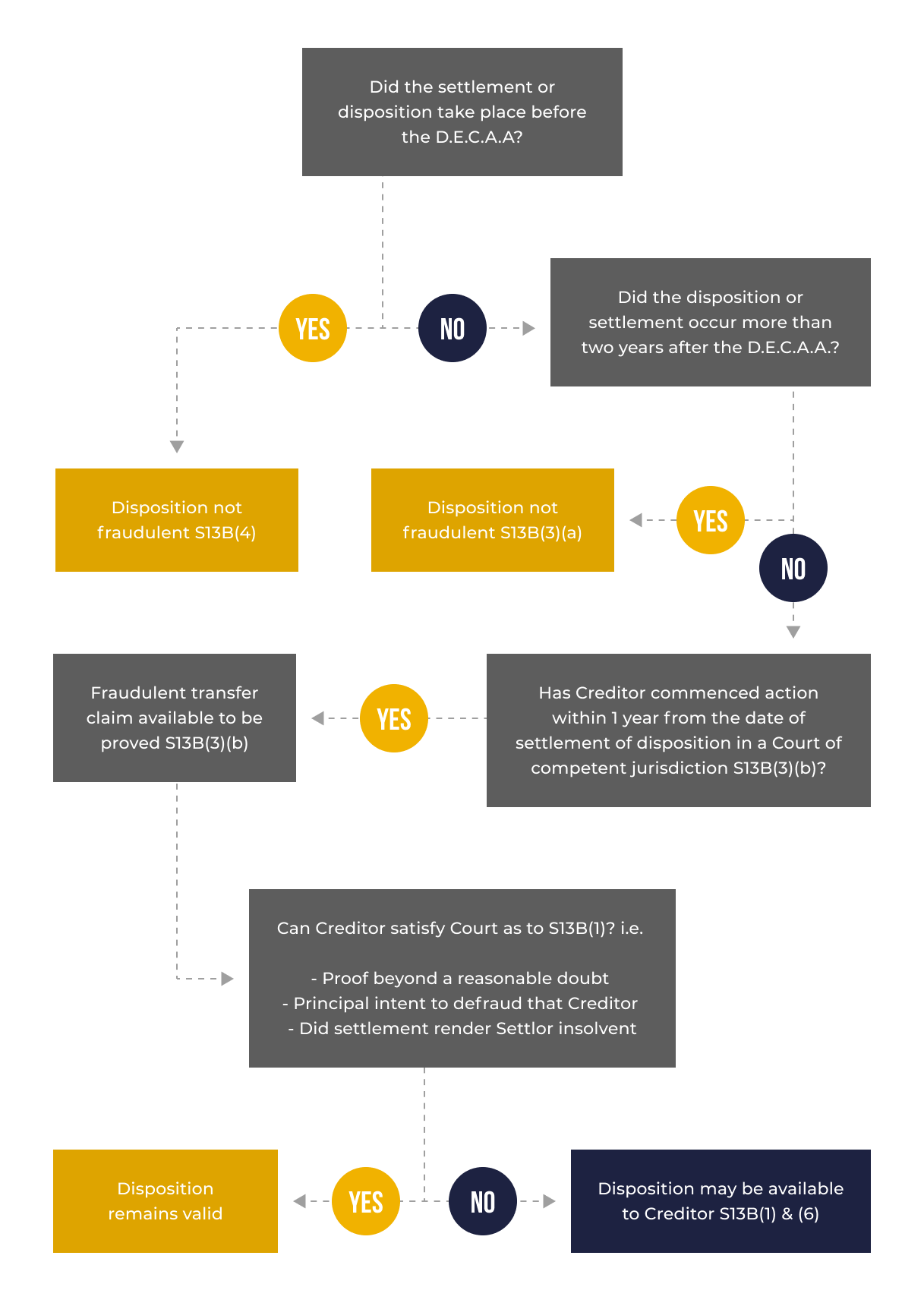

Assessing the Validity of Claims Under Section 13B

- Determine the Date the Earliest Cause of Action Accrued (D.E.C.A.A.):

- This is the date when the event or incident occurred that triggered the creditor’s claim.

- Check if the Settlement or Disposition Occurred Before the D.E.C.A.A.:

- If yes, the disposition is not considered fraudulent under Section 13B(3b).

- If no, proceed to the next step.

- Check if the Settlement or Disposition Occurred More Than Two Years After the D.E.C.A.A.:

- If yes, the disposition is not considered fraudulent under Section 13B(4).

- If no, proceed to the next step.

- Determine if the Creditor Commenced Action Within One Year from the Date of Settlement or Disposition in a Court of Competent Jurisdiction:

- If yes, the creditor may proceed with the fraudulent transfer claim under Section 13B(3)(b).

- If no, the disposition is not considered fraudulent under Section 13B(3)(b).

- Evaluate if the Creditor Can Satisfy the Court on the Following Points Under Section 13B(1):

- Proof beyond a reasonable doubt of the fraudulent intent.

- Principal intent was to defraud the creditor.

- The settlement rendered the settlor insolvent.

- Final Outcomes Based on Evaluation:

- If the creditor meets the criteria in Section 13B(1), the disposition may be available to the creditor.

- If the creditor does not meet the criteria, the disposition remains valid and protected.

The chart below provides a clear, step-by-step approach to evaluating claims under Section 13B, helping you to systematically assess whether a disposition meets the legal requirements for being considered fraudulent.

Combined Effect of Both Conditions

For a creditor to be barred from challenging the trust or disposition, both conditions must be satisfied:

Post-Two-Year Condition: If the trust or asset transfer occurs after the two-year period from the creditor’s cause of action, the creditor is barred from bringing a claim, regardless of whether they take action or not.

Pre-Two-Year Condition: If the trust or asset transfer occurs within the two-year period, the creditor must file a claim within one year of the event to avoid being barred.

In summary, the statute of limitations is interdependent: the first condition sets the timeframe within which the creditor can act, and the second condition specifies the period within which action must be taken if the first condition is met.

Importance of Understanding the Timeframes

Understanding these timeframes is vital for both trust settlers and creditors:

For Trust Settlers: Knowing these limits helps in planning and executing asset protection strategies effectively. By ensuring that trusts are set up either well before the two-year window or managing the timing of transfers carefully, settlers can avoid challenges from creditors.

For Creditors: Being aware of these limitations helps in deciding when and how to initiate claims. Creditors must act within the specified timeframes to avoid being barred from contesting the trust or asset disposition.

Conclusion

The Cook Islands’ statute of limitations for fraudulent conveyance claims provides a clear framework that impacts both the establishment of offshore trusts and the ability to challenge them. By understanding these conditions—both the two-year and one-year requirements—you can better navigate asset protection and litigation strategies.

If you are considering setting up a Cook Islands Trust or if you need assistance with a fraudulent conveyance claim, consulting with experienced legal professionals is essential. At Blake Harris Law, we have extensive experience with Cook Islands trusts and can guide you through the complexities of asset protection and legal compliance.

For more information or to discuss your asset protection needs, contact Blake Harris Law today.