Quick Summary

Trusts and Limited Liability Companies (LLCs) serve different purposes. Trusts focus on long-term wealth preservation and estate planning, while LLCs provide business flexibility and liability separation. Your choice depends on whether your primary goal is to transfer wealth privately or protect personal assets from business risks. This article compares trusts and LLCs, highlighting their key differences in purpose, liability protection, control, taxation, and privacy.

Stuck Between Trust vs LLC for Asset Protection?

When it comes to safeguarding your assets, choosing the right strategy makes all the difference.

Trusts and LLCs are two of the most popular options for protecting wealth, but each offers unique benefits. As such, understanding their key offerings and comparing their differences will help you select the ideal asset protection plan tailored to your specific needs.

In this article, we will explain the distinct features of trusts and LLCs, comparing them in terms of asset protection and wealth management.

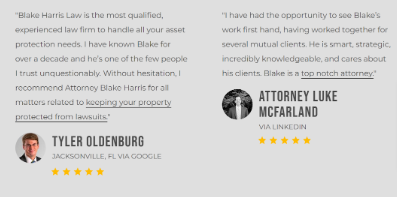

Why Listen to Us

At Blake Harris Law, we specialize in offshore asset protection with years of experience and a global network of trusted professionals. Our dedicated team, led by Managing Attorney Blake Harris, ensures personalized solutions and exceptional client service. Trust our expertise to guide you through the complexities of Trusts vs LLCs for effective wealth management.

What Is a Trust?

A trust is a legal and fiduciary arrangement where a trustee holds and manages assets, such as real estate, investments, and cryptocurrency, on behalf of beneficiaries, based on instructions set by the grantor. By transferring ownership to the trust, you can reduce exposure to lawsuits, creditors, and probate.

Common uses of Trusts

- Asset Protection: Trusts, especially irrevocable and offshore trusts, provide a strong shield against creditors, lawsuits, and other financial threats.

- Estate Planning: Trusts are an essential tool in managing how your assets are distributed after your death.

- Wealth Management: Trusts can also help with the strategic management and growth of your wealth over time, ensuring your assets are utilized and protected according to your wishes.

Key types of Trusts

- Revocable Trusts: These trusts allow the grantor to maintain control over the assets and make changes or revoke the trust entirely.

- Irrevocable Trusts: Once established, these trusts cannot be changed or revoked by the grantor. We have broken down the difference between revocable trusts and irrevocable trusts here.

- Offshore Trusts: These are trusts set up in jurisdictions outside the U.S., such as the Cook Islands, Nevis, and Belize, known for their robust asset protection laws. At Blake Harris Law, we specialize in helping clients establish offshore trusts in these jurisdictions to ensure maximum asset protection and security from legal threats.

Pros of Trusts for Asset Protection

- Irrevocable and offshore trusts offer strong protection from creditors, lawsuits, and divorce.

- Trusts can reduce estate and income taxes when structured properly

- You can set terms for inheritance, ensuring assets are managed according to your wishes

- Trusts are typically not public, maintaining privacy

- Jurisdictions like the Cook Islands, Nevis, and Belize offer superior protection from international threats

Cons of Trusts for Asset Protection

Setting up a trust, especially offshore, requires careful legal structuring.

Trustee fees can be significant, depending on complexity and jurisdiction

Trusts are not designed for active business operations

What Is an LLC?

A Limited Liability Company (LLC) is a business structure that combines the flexibility of a partnership with the liability protection of a corporation. It is a separate legal entity that protects its owners, known as members, from personal liability for business debts and lawsuits. In essence, LLCs help shield personal assets from financial obligations tied to the business.

Common Uses of LLC

- Business Operations: LLCs are ideal for small to medium-sized businesses, including those involved in real estate, professional services, and retail.

- Liability Protection: The key reason to use an LLC is to protect personal assets from business-related lawsuits or debts.

At Blake Harris Law, we help clients form Nevis LLCs to maximize asset protection and shield wealth from potential threats.

Pros of LLC for Asset Protection

- Shields personal assets from business debts and lawsuits

- Can be taxed as a pass-through or corporation

- Less paperwork and formalities than corporations

- Can be owned by individuals, trusts, or other entities

- Can operate indefinitely with proper structuring

Cons of LLC for Asset Protection

- Creditors may access personal assets if LLC formalities are not followed

- Protection varies by jurisdiction and compliance is required

- Owners may face higher personal taxes if taxed as a pass-through entity

- Business ownership is often publicly recorded

Trust vs LLC: Head-to-Head Comparison

| # | Category | Trust | LLC |

| 1. | Primary purpose | Estate planning, managing/distributing assets | Operating a business, insulating personal assets |

| 2. | Control | Grantor & Trustee | Members & Managers |

| 3. | Liability Protection | Varies by type (e.g, Asset Protection Trusts offer strong protection) | Strong shield for members’ personal assets |

| 4. | Privacy | Generally private documents | Membership is often part of the public record |

| 5. | Tax Implications | Varies greatly by trust type. | Typically pass-through taxation |

| 6. | Formation | Created via a trust agreement | Filed with the state |

| 7. | Best Use | Long-term wealth transfer, estate tax planning, and privacy | Active business operations, rental properties, professional |

The main difference between a trust and LLC is that a trust focuses on asset protection and estate planning, while an LLC shields business owners from liability. To help you understand their differences better, we’ve compared them side-by-side, highlighting their key distinctions across several categories.

1. Primary Purpose

Trusts Prioritize Asset Protection and Estate Planning

A trust is designed to preserve wealth and control its distribution over time. It shields assets from lawsuits, creditors, and probate, making it a strong tool for long-term financial security. Trusts provide structured asset management, ensuring beneficiaries receive assets according to the grantor’s terms.

LLCs Focus on Business Operations and Liability Protection

An LLC is a business structure that separates personal and business liabilities, protecting owners from financial risk. It allows individuals to conduct operations, hold assets, and transact without exposing personal wealth. However, an LLC is not inherently structured for long-term wealth protection beyond its business scope.

2. Liability Protection

Trusts Offer Stronger Asset Protection

A trust removes legal ownership from the individual and places it under a trustee, making it difficult for creditors, lawsuits, or legal claims to access the assets. Offshore trusts in Cook Islands, Nevis, and Belize provide additional security, as these jurisdictions have strict barriers against foreign legal challenges.

Wondering how much Cook Island Trust costs to set up and& maintain? We have answered your question in this article.

LLCs Limit Business Liability but Have Risks

An LLC protects owners by separating personal and business liabilities, ensuring that business debts and lawsuits do not typically affect personal assets. However, this protection is not absolute, courts can pierce the corporate veil if the LLC is not properly maintained or if personal and business finances are commingled.

3. Ownership and Control

Trusts Shift Control to the Trustee (in Most Cases)

A trust transfers legal ownership of assets to a trustee, who manages them according to the trust’s terms. The grantor sets the rules for asset distribution, but once the trust is established; particularly an irrevocable trust, the grantor has limited direct control.

LLC Owners Maintain Direct Control

An LLC allows owners to retain complete control over business decisions and asset management. Members can personally manage the LLC or appoint managers, offering flexibility. Unlike a trust, an LLC does not require an external party to oversee assets, making it preferable for those wanting hands-on authority.

4. Tax Treatment

Trusts Have Unique Tax Implications

A trust’s tax liability depends on its structure. Revocable trusts allow the grantor to maintain control and pay taxes on income as personal earnings. Irrevocable trusts, however, are separate tax entities, potentially reducing estate taxes but requiring compliance with specific tax rules.

LLCs Offer Flexible Taxation

An LLC provides tax flexibility, allowing owners to choose between pass-through or corporate taxation. By default, LLC profits pass directly to members, avoiding double taxation. However, electing C-corp or S-corp status may provide tax advantages, particularly for business owners with significant earnings.

5. Privacy and Public Records

Trusts Provide Greater Confidentiality

A trust offers a higher level of privacy because it does not require public registration. The trustee manages assets without needing ownership disclosures, making trusts ideal for those seeking to keep their wealth shielded from public records and legal scrutiny.

LLCs Require Public Filings

An LLC must register with the state; ownership details may be accessible through business filings. While some jurisdictions offer anonymous LLCs, most require disclosing at least one managing member. This makes LLCs less private than trusts, particularly for asset protection purposes.

When to Choose a Trust or LLC

The right choice between a Trust and an LLC depends entirely on your primary objective. Here’s how to decide.

Choose a Trust When:

- Your priorirty is estate planning and ensuring smooth transfer of wealth to heirs.

- You want to avoid probate and maintain privacy.

- You’re seeking international asset protection with offshore options.

Choose an LLC When:

- You operate a business or hold rental/investment property with potential liabilities.

- You want hands-on control of day-to-day operations.

- You prefer flexible taxation and simpler maintenance than a corporation.

Use a Trust and an LLC Together When:

- You need ongoing business operations and also want long-term wealth transfer.

- You hold high-value assets that benefit from both liability separation and inheritance planning.

Setting Up a Trust or LLC with Blake Harris Law

At Blake Harris Law, we have helped thousands of high-income professionals, entrepreneurs, real estate investors, and cryptocurrency holders establish trusts and LLCs to protect their assets. We assist with domestic and offshore trust creation, LLC formation, and coordination of trust-owned LLC structures for layered protection. Contact us today to explore the best asset protection strategy for your needs.