Quick Summary

This article explores how bankruptcy works, the types of lawsuits it can stop, and the protections it offers, including the automatic stay. Learn how bankruptcy can help you regain control of your finances and safeguard your assets legally. Visit our blog for more insights and guides on safeguarding your wealth.

Can Filing for Bankruptcy Protect You from a Lawsuit?

While bankruptcy is typically viewed as a last resort for those overwhelmed by debt, it can also provide relief in certain legal circumstances. In 2024, over 517,308 bankruptcy cases were filed, a 14.2% increase from the 452,990 filed in 2023, according to the U.S. Bankruptcy Courts statistics.

One of the key benefits of bankruptcy is the automatic stay, which temporarily halts most legal actions against you. But can it truly stop a lawsuit?

In this Blake Harris Law article, we will explore how bankruptcy can protect you from lawsuits, the types of cases it can stop, and the limitations you should consider before deciding to file.

Why Listen to Us

At Blake Harris Law, we focus on asset protection, helping clients use legal strategies to preserve wealth while addressing creditor lawsuits. Our experience includes guiding individuals through long-term asset protection, ensuring clients are protected both now and in the future.

What is Bankruptcy and How Does It Work?

Before getting to how bankruptcy can stop lawsuits, it is important to understand what bankruptcy actually is.

In simple terms, bankruptcy is a legal process that helps individuals or businesses overwhelmed by debt get a fresh start. It involves either the liquidation of assets to pay off creditors (Chapter 7) or the reorganization of debts (Chapter 13) to allow the debtor to repay them over time.

Chapter 7 vs. Chapter 13 Bankruptcy

- Chapter 7 – Liquidation Bankruptcy: This process involves selling off non-exempt assets to repay creditors. Once the assets are sold, the remaining eligible debts are discharged by the court, giving the debtor a legal fresh start.

- Chapter 13 – Reorganization Bankruptcy: This option allows individuals to keep their property while reorganizing their debts. A repayment plan is put in place over three to five years, and once the plan is completed, remaining eligible debts are discharged.

Not sure of which of your assets will be protected in the event of bankruptcy? Check our guide on what assets are protected in bankruptcy.

What Happens When You File for Bankruptcy?

Filing for bankruptcy triggers a series of protections. This suite of legal shields and benefits that work together to help you regain the control of your finances. They include:

- Automatic Stay: Halts most legal actions, including lawsuits and wage garnishments.

- Debt Discharge: Eliminates qualifying debts, offering relief from credit cards and medical bills.

- Property Exemptions: Protects essential assets like your home, car, and certain financial holdings, including cryptocurrency where permitted, depending on state exemption laws.

- Repayment Plans: Chapter 13 allows you to repay debts while keeping your property.

- Creditor Priority Rules: Ensures secured creditors are paid before unsecured creditors.

- Fresh Start Provision: Allows you to rebuild financially after certain debts are legally discharged.

The most significant benefit, especially for those facing lawsuits, is the automatic stay, which halts most legal actions, providing critical time to resolve financial matters.

Automatic Stay Explained

Automatic stay is a provision outlined in Section 362 of the U.S. Bankruptcy Code, which is automatically triggered upon filing your bankruptcy petition.

Once triggered, it offers crucial relief by halting most legal actions against you, giving you the opportunity to organize your finances, negotiate with creditors, or explore debt restructuring options (especially under Chapter 13), all under the protection of the bankruptcy court.

How Long Does It Last?

For Chapter 7, an automatic stay usually lasts until the case is closed or debts are discharged. However, for Chapter 13 bankruptcy, it can last through the repayment plan, usually three to five years. This relief allows you to focus on your financial recovery without the immediate threat of losing your assets or being overwhelmed by creditors, while the stay remains in effect.

Types of Lawsuits That Bankruptcy Can Stop

As previously mentioned, filing for bankruptcy stops various types of lawsuits and collection actions. Below are the key types of legal actions bankruptcy can prevent:

Civil Lawsuits Involving Debt

Bankruptcy can stop lawsuits related to debt collection, providing essential relief. Examples include:

- Credit Card Debt: Stops lawsuits filed by credit card companies seeking payment.

- Medical Bills: Halts lawsuits from medical providers for unpaid hospital or doctor bills.

- Personal Loans: Prevents legal actions related to personal loans from creditors.

- Business Debts: Stops lawsuits filed by creditors seeking payment for business-related debts.

Foreclosures and Evictions

Bankruptcy can temporarily stop foreclosure proceedings and evictions, providing you with valuable time to catch up on missed payments.

Under Chapter 13 bankruptcy, you can set up a repayment plan to address arrears over time and keep your home. However, if a landlord has already obtained a court judgment for eviction, the automatic stay may not prevent the eviction from moving forward.

In some cases, you can still work out a resolution with your tenant or cure your default.

Wage Garnishments and Bank Levies

Bankruptcy can stop wage garnishments and bank levies,protecting your income and accounts from creditor collection efforts under the court’s protection.

- Wage Garnishments: Prevents creditors from taking a portion of your paycheck to satisfy outstanding debts.

- Bank Levies: Stops creditors from freezing or seizing funds in your bank accounts, including accounts holding cryptocurrency, where applicable under state law, to settle unpaid debts.

Additionally, funds garnished or levied within a certain period before filing may be recoverable.

Personal Injury Lawsuits

Bankruptcy can stop collection efforts related to personal injury lawsuits, though it may not discharge all related debts.

- Medical Injury Debts: Stops collection efforts on personal injury lawsuits resulting from medical negligence, although it does not eliminate the debt in all cases.

- Car Accident Claims: Temporarily halts collection for personal injury claims from car accidents, but debts arising from intentional harm or DUI-related accidents are generally not dischargeable.

Types of Lawsuits Bankruptcy Cannot Stop

While bankruptcy offers valuable protections, it does not stop every type of legal action. Certain lawsuits and obligations remain unaffected by the bankruptcy process.

Criminal Cases

Bankruptcy cannot stop criminal cases. If you are facing criminal charges, filing for bankruptcy will not prevent the legal process from continuing. Bankruptcy does not discharge fines, restitution, or penalties related to criminal offenses.

The automatic stay does not apply to criminal proceedings, meaning authorities can continue prosecuting a criminal case even if you are in bankruptcy. Additionally, any debts arising from criminal activity, such as restitution, cannot be eliminated through bankruptcy.

Family Law Matters

Bankruptcy offers no protection from family law obligations. Debts related to child support, alimony, and spousal maintenance are considered non-dischargeable under bankruptcy law. No matter the type of bankruptcy you file for, these obligations remain intact.

In Chapter 13 bankruptcy, these debts are prioritized, and you will still be required to pay them in full as part of your repayment plan. This ensures that family support obligations are met, even as you work through bankruptcy.

Certain Evictions

Bankruptcy can temporarily halt eviction proceedings in some cases, but it does not apply in all situations.

For example, if a landlord has already obtained a judgment of possession before the bankruptcy filing, the automatic stay will not prevent eviction. However, in cases where the eviction is based on nonpayment of rent, bankruptcy may provide a temporary reprieve, allowing you time to address missed rent payments and preserve your housing.

In Chapter 13 bankruptcy, you may be able to include back rent in your repayment plan to keep your home.

Fraudulent Claims

Debts arising from fraudulent actions are not dischargeable in bankruptcy. If a creditor can prove that a debt was incurred through fraud, such as lying on a loan application or using deceitful tactics, that debt cannot be wiped away in bankruptcy.

For instance, If you or a business partner engaged in fraudulent activity, such as misrepresenting financial information or making false claims, the debts related to these actions will remain even after bankruptcy. Also, creditors may file an adversary proceeding to challenge the dischargeability of fraudulent debts.

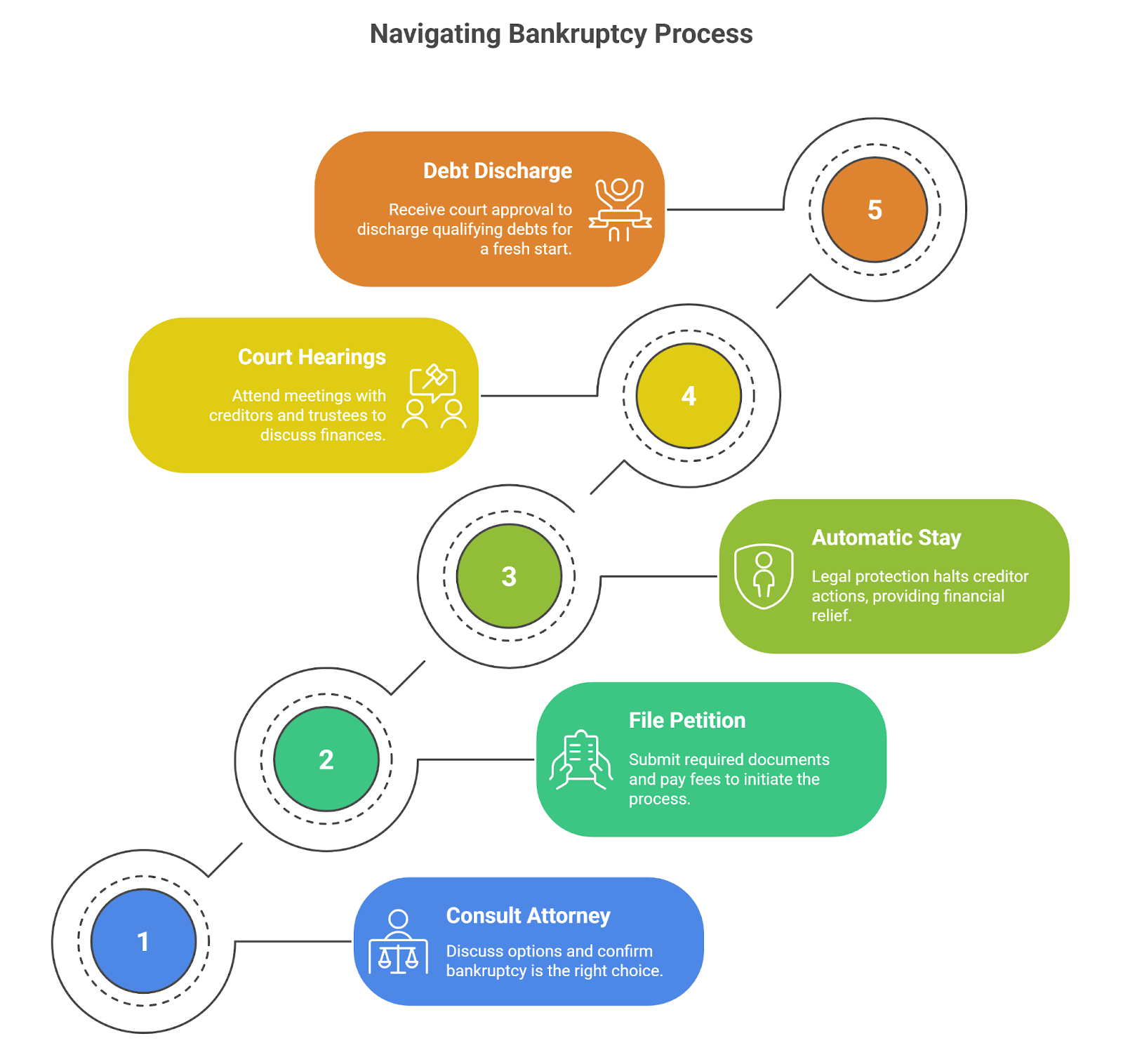

The Process of Filing for Bankruptcy to Stop a Lawsuit

Filing for bankruptcy can offer immediate protection from lawsuits and aggressive creditor actions. Here’s an overview of the process:

1. Consultation with a Bankruptcy Attorney

The first step is to consult with a bankruptcy attorney. This is crucial to understand your options and confirm that bankruptcy is the right choice for your situation. An experienced attorney will assess your finances and help you navigate the process effectively.

2. Filing the Bankruptcy Petition

To begin, you must file a petition with the court. This includes:

- Credit Counseling: Completing a required session with an approved credit counseling agency.

- Financial Documents: Providing detailed information about your debts, assets, income, and expenses.

- Filing Fees: Paying court fees, which may be waived or paid in installments based on your financial situation.

Once the petition is filed, the automatic stay is triggered, stopping most lawsuits and creditor actions.

3. Automatic Stay Activation

When you file for bankruptcy, the automatic stay immediately halts most legal actions against you, including lawsuits, wage garnishments, and foreclosures. This protection gives you breathing room to reorganize your finances. However, certain actions like child support obligations and criminal proceedings are not stopped by the stay.

4. Court Hearings and Discharge

- 341 Meeting of Creditors: About 30 days after filing, you’ll attend a meeting with the bankruptcy trustee and creditors to answer questions about your financial situation. Your attorney will guide you through this process.

- Debt Discharge: If all goes as planned, the court will grant a discharge of qualifying debts, offering you a fresh start.

Understanding these steps is key to leveraging bankruptcy’s protections effectively. Working with a qualified bankruptcy attorney ensures you are guided through this process with confidence.

Protect Your Assets Before Bankruptcy

While filing bankruptcy offers important protections, individuals can often achieve stronger safeguards by implementing legal asset protection strategies in advance, before financial challenges arise. Strategic planning helps protect valuable property, increasing the likelihood of retaining what matters most during the bankruptcy process.

Here are some strategies you can put in place:

- Pay Down Secured Debts: Paying down secured debts can help protect the equity in exempt assets, such as your home or car.

- Establish Irrevocable Trusts: Establishing irrevocable trusts can help preserve assets and maintain financial privacy, but they must be structured in advance and in compliance with applicable laws.

- Domestic Asset Protection Trusts (DAPTs): In certain states, DAPTs can protect assets when structured within the law. Asset transfers should be structured well in advance and in compliance with bankruptcy rules, since last-minute transfers to family members may be challenged by the court.

- Offshore Trusts: For additional legal protection, assets can be structured in recognized jurisdictions such as the Cook Islands, Nevis, or Belize, which provide strong privacy and creditor protection laws.

- Create Limited Liability Entities: Structuring assets through LLCs or corporations can create a legal separation between personal and business liabilities, helping preserve financial privacy and limit exposure to potential claims.

- Purchase Exempt Assets: Buying exempt assets, such as necessary household goods, can strengthen legally recognized protections when preparing for bankruptcy.

- Maximize Retirement Contributions: Contributing to retirement accounts like 401(k)s and IRAs can help protect your savings from creditors, including cryptocurrency investments held in retirement accounts where permitted.

However, the success of these strategies depends on factors like timing, proper structuring in the right locations, and choosing the right asset protection attorney for guidance.

Work with an Asset Protection Attorney for Better Protection

At Blake Harris Law, our team focuses on asset protection strategies to guide clients through the complex process of safeguarding wealth. We carefully evaluate your financial situation and create customized solutions designed to preserve assets within the law.

These include tailored asset protection solutions like:

- Offshore Trusts: For stronger legal safeguards, we help clients establish offshore trusts in jurisdictions like the Cook Islands, Nevis, and Belize. These jurisdictions have well-established trust laws that provide privacy and protection when structured in full compliance with applicable regulations.

- Limited Liability Companies (LLCs): We guide clients through setting up LLCs in jurisdictions with favorable legal protections.

From the initial consultation through the final discharge, we provide ongoing support to guide clients through the process and help reduce uncertainty. Our goal is to support a more favorable outcome for each financial situation.

Contact us today for a confidential consultation.