Quick Summary

California homeowners face the risk of losing their property in lawsuits, but there are effective strategies to protect it. Learn about the homestead exemption, irrevocable trusts, offshore trusts, LLCs, and other asset protection measures to help shield your home from potential creditors and legal claims. Read more asset protection guides in our blog.

Could a Lawsuit Put Your Home at Risk in California?

Losing your home in a lawsuit is a significant concern for homeowners, especially in California where high property values make homes vulnerable to legal claims.

Understanding the protections available is crucial to safeguarding your property. California’s laws, including the homestead exemption, offer important safeguards, but they may not provide full protection in every case.

This Blake Harris Law article explores the potential risks to homeownership in California lawsuits and the legal measures you can take to protect your property.

Why Listen to Us?

At Blake Harris Law, we focus on asset protection and understand the intricacies of California’s legal landscape. Our attorneys provide personalized strategies to strengthen legal protections for your home against potential lawsuits. With our specialized guidance, clients can take steps to strengthen protections for their property and navigate legal challenges with greater confidence.

Can You Lose Your Home in a Lawsuit in California?

The short answer is “Yes.” It is possible to lose your home in a lawsuit in California. This is because, under state law, creditors can sue for almost everything you own. Homeowners without carefully planned protections may face potential exposure of their property and other assets, including their home.

Lawsuits That Can Threaten Homeownership in California

Several types of lawsuits or debts can put your home in jeopardy:

Mortgage Foreclosure Lawsuits

If you default on your mortgage payments, the lender can initiate foreclosure proceedings.

In California, lenders often use nonjudicial foreclosure, which allows them to foreclose without going to court, as long as your mortgage includes a power of sale clause. If you fall behind on payments, your lender may sell your home at auction to recover the debt.

Homeowners Association (HOA) Foreclosures

Unpaid HOA dues can also lead to foreclosure, even if your mortgage is current. HOAs can place liens on your property and foreclose to recover unpaid fees. It’s crucial to stay current on HOA dues to avoid the risk of losing your home.

Tax Liens and Foreclosures

If you fail to pay property taxes, the county can place a tax lien on your home. If the debt remains unpaid, tax authorities can eventually initiate foreclosure and sell your property to recover the unpaid taxes, putting your home at risk.

Judgment Liens from Lawsuits

If a creditor wins a lawsuit against you, they can place a judgment lien on your property. This lien can prevent you from selling or refinancing your home. If the debt remains unpaid, the creditor could eventually initiate foreclosure proceedings to recover the owed amount.

Wrongful Foreclosure Actions

In rare cases, lenders may improperly initiate foreclosure proceedings. This is known as wrongful foreclosure. If you believe your foreclosure was initiated in error, you may have legal grounds to challenge it and potentially retain ownership of your home.

Breach of Contract or Fraud in Real Estate Transactions

Lawsuits related to breach of contract or fraud in real estate transactions can also result in the loss of homeownership. For example, if a seller fails to disclose significant property issues or violates the terms of the sale, you might face legal challenges that could impact your ownership status.

However, California law offers some protection through the homestead exemption, which allows homeowners to protect a portion of their home’s equity from creditors.

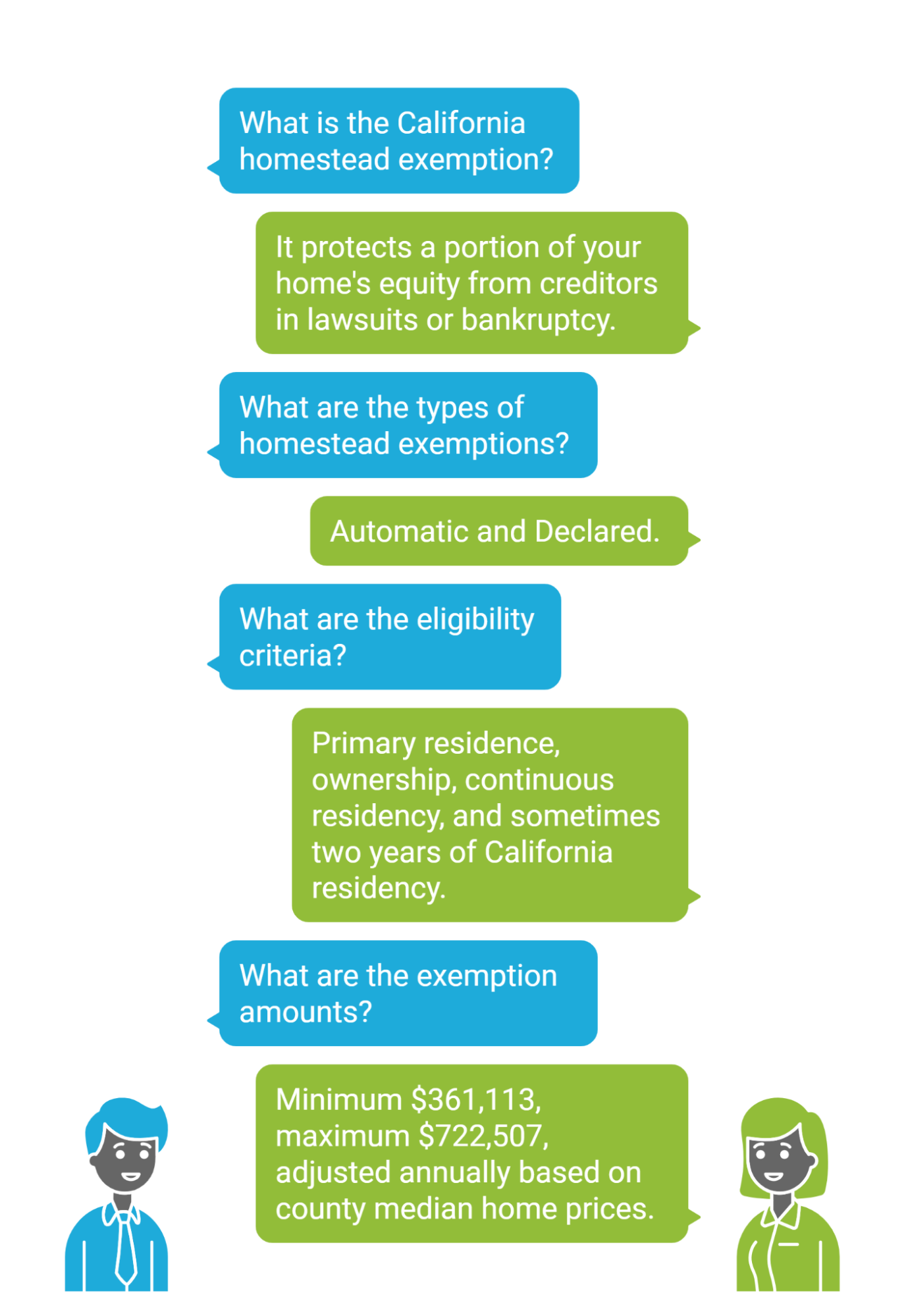

What is the California Homestead Exemption?

California’s homestead exemption is a crucial legal protection designed to help homeowners shield a portion of their home’s equity from creditors in the event of a lawsuit or bankruptcy. This exemption prevents creditors from seizing the equity in your home to satisfy a debt, allowing you to preserve your living situation despite financial setbacks.

It is of two types:

- Automatic Homestead Exemption: Protects a portion of your home’s equity automatically.

- Declared Homestead Exemption: You can file a declaration to enhance your protection and reinvest proceeds into a new home within six months.

Eligibility Criteria

- The property must be your primary residence.

- You must own the property, either outrightly or through a mortgage.

- You must have continuously resided in the home since the judgment lien was attached.

In some cases, you must have lived in California for at least two years to qualify for California’s exemptions in a bankruptcy filing.

Exemption Amounts

California is a partial homestead state, meaning homeowners can protect a portion of their primary residence’s equity, but not all of it. As of January 1, 2025, the homestead exemption in California is a minimum of $361,113 and a maximum of $722,507.

The exact exemption amount is determined by the median sale price of a single-family home in your county during the prior calendar year. If the median price is below $361,113, the exemption defaults to the minimum. If it exceeds $722,507, the exemption is capped at $722,507. The exemption amount is adjusted annually for inflation.

Limitations of the Homestead Exemption in California

While California’s homestead exemption offers valuable protection by allowing homeowners to shield a portion of their home’s equity from creditors, there are key limitations:

- Only Protects Equity, Not Home Value: The homestead exemption applies only to the equity in your home, not its total value. Equity is the difference between the market value of the property and any outstanding mortgages or liens. If you have little to no equity in your home, the exemption provides no protection.

- Does Not Protect Against Mortgage Foreclosures: The homestead exemption does not prevent foreclosure if you default on your mortgage. If you fail to make mortgage payments, the lender can still foreclose on the property and sell it, regardless of the homestead exemption.

- Does Not Protect Against Tax Liens: If you fail to pay property taxes, the county can place a tax lien on your home. The homestead exemption does not prevent tax authorities from foreclosing on your property to recover unpaid taxes.

- Exemption Limits: The homestead exemption only protects part of your home’s equity, which means high-value properties in areas like Los Angeles or San Francisco may remain partially vulnerable to creditor claims.

- Creditor Liens: Creditors can still place judgment liens on your property, even if you qualify for the homestead exemption. These liens can complicate your ability to sell or refinance your home, and if the debt remains unpaid, could eventually lead to foreclosure.

- Certain Debts Are Not Covered: The exemption does not protect against certain types of debts. For example, obligations like child support, spousal support, or criminal restitution take priority over the homestead exemption and may still result in legal action that could affect your home.

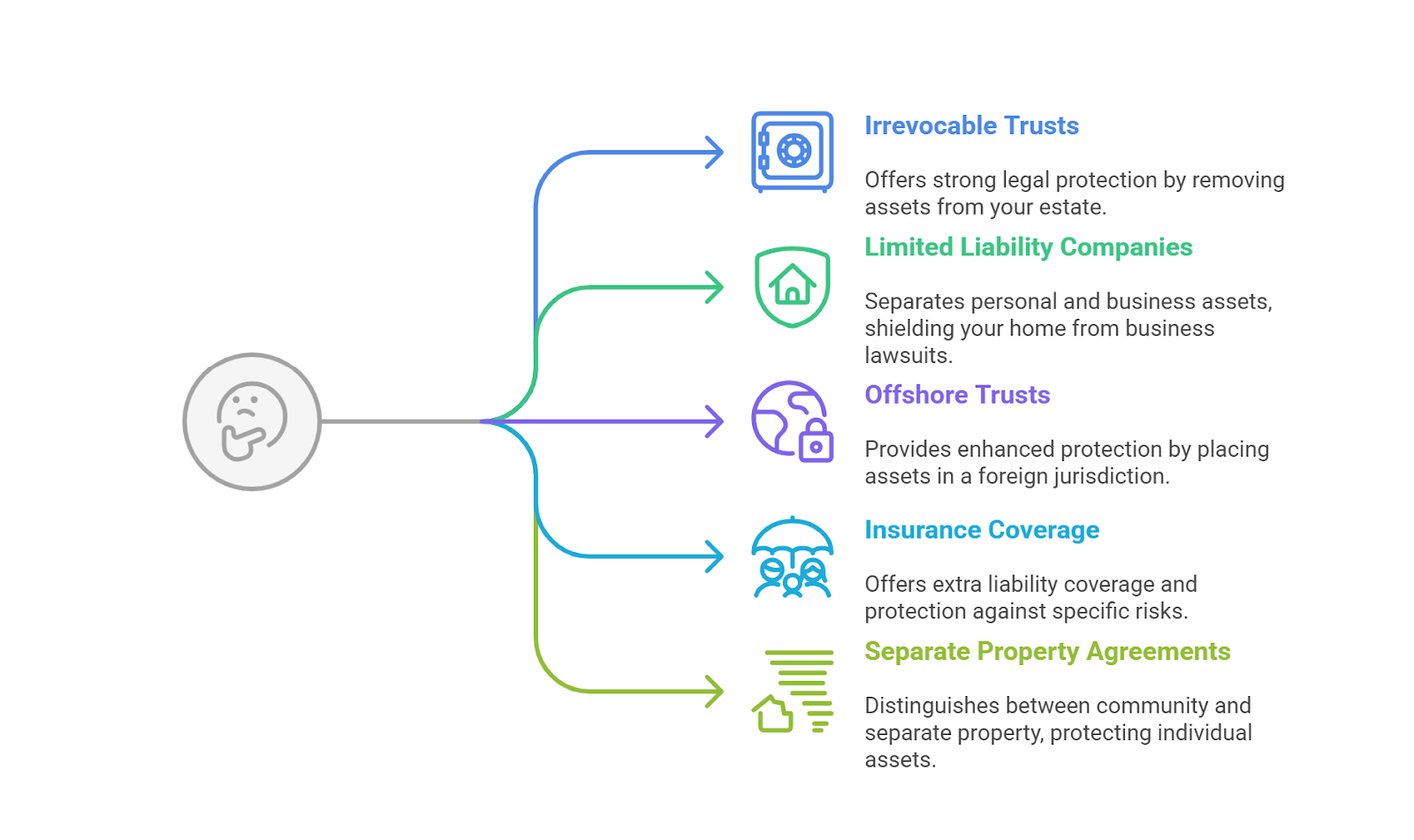

Proactive Protection Strategies for California Homeowners

While California’s homestead exemption provides some protection for homeowners, it doesn’t fully shield your home from all legal threats. To ensure better protection for your property, consider implementing the following strategies:

Establishing Irrevocable Trusts

Transferring assets into an irrevocable trust can help preserve them within the law. Once assets are placed in the trust, they are generally treated as legally distinct from your personal estate, creating an added layer of protection against potential claims while remaining fully compliant with legal requirements.This strategy is particularly useful for individuals with potential exposure to lawsuits.

Forming Limited Liability Companies (LLCs)

If you own multiple properties or run a business, setting up an LLC can separate personal assets from business liabilities within legal limits. This structure can help protect personal property, including your home and other high-value assets like cryptocurrency, from business-related lawsuits.

Offshore Trusts

For high-net-worth individuals, offshore trusts in jurisdictions such as the Cook Islands, Nevis, and Belize can enhance protection by placing assets under the management of a trustee outside the U.S., helping preserve financial privacy and reduce legal exposure in compliance with applicable laws. Because setting up asset protection trusts is complex, it is essential to work with a legal specialist to ensure compliance with the law.

Insurance Coverage

Comprehensive insurance is a cornerstone of asset protection. Consider coverage for high-value digital assets, such as cryptocurrency, alongside traditional homeowner policies. Recommended options include:

- Umbrella Insurance: Provides extra liability coverage beyond standard homeowner policies, helping mitigate potential financial exposure from large lawsuits.

- Professional Liability Insurance: Important for professionals like doctors or lawyers, offering coverage for claims related to their work.

- Landlord Insurance: Helps property owners manage risks associated with tenants and rental properties, including potential liability claims.

Separate Property Agreements

In California, distinguishing between community property and separate property can help protect individual assets from lawsuits. This is especially beneficial for professionals, such as business owners or doctors, who face higher litigation risks.

Protect Your California Home from Potential Legal Challenges with Blake Harris Law

At Blake Harris Law, we specialize in helping California homeowners implement effective asset protection strategies to safeguard their homes and wealth. With our in-depth knowledge of state laws and proven strategies, our attorneys guide you through a variety of legal options, including:

- Establishing Offshore Trusts in countries like Nevis, Cook Islands, and Belize for enhanced protection against lawsuits and creditors.

- Forming Limited Liability Companies (LLCs) to separate personal and business assets.

- Maximizing Insurance Coverage to ensure you are fully protected against liability claims.

Our asset protection attorneys work with clients to develop tailored plans that help safeguard property, homes, and digital assets like cryptocurrency, reducing legal risks, preserving financial privacy, and supporting long-term stability.

Contact Blake Harris Law today to schedule a consultation and discover the right legal strategies to protect your home from potential lawsuits in California.