Quick Summary

Doctors face high legal and financial risks that can jeopardize their personal assets. This article explains why proactive asset protection for doctors is essential and outlines effective strategies, including LLCs, trusts, insurance, and estate planning. We also provide actionable tips for layering these strategies. Visit our blog for more insights and guides on safeguarding your wealth.

Wondering How Exposed You Are as a Medical Doctor?

One malpractice lawsuit can destroy decades of hard work. Medical professionals face threats from multiple directions: patient claims, regulatory violations, and opportunistic litigation. Without proper protection, your personal assets become targets.

In this Blake Harris Law article, we explain why asset protection for doctors is critical and provide six proven strategies to preserve your wealth. We cover everything from business structures to offshore trusts, giving you the tools to build legal barriers around your assets.

Why Listen to Us

At Blake Harris Law, we specialize in helping medical professionals structure assets for confidentiality and limit legal exposure. Our team has guided hundreds of clients through compliant asset protection strategies, including offshore trusts, LLCs, and estate plans. We understand the unique challenges of medical practice and offer legal security tailored to physicians needs.

Why Asset Protection for Doctors Is Crucial

Medical practice creates a unique vulnerability to legal claims. Even without wrongdoing, physicians face significant exposure due to the high stakes of patient care and complex healthcare regulations.

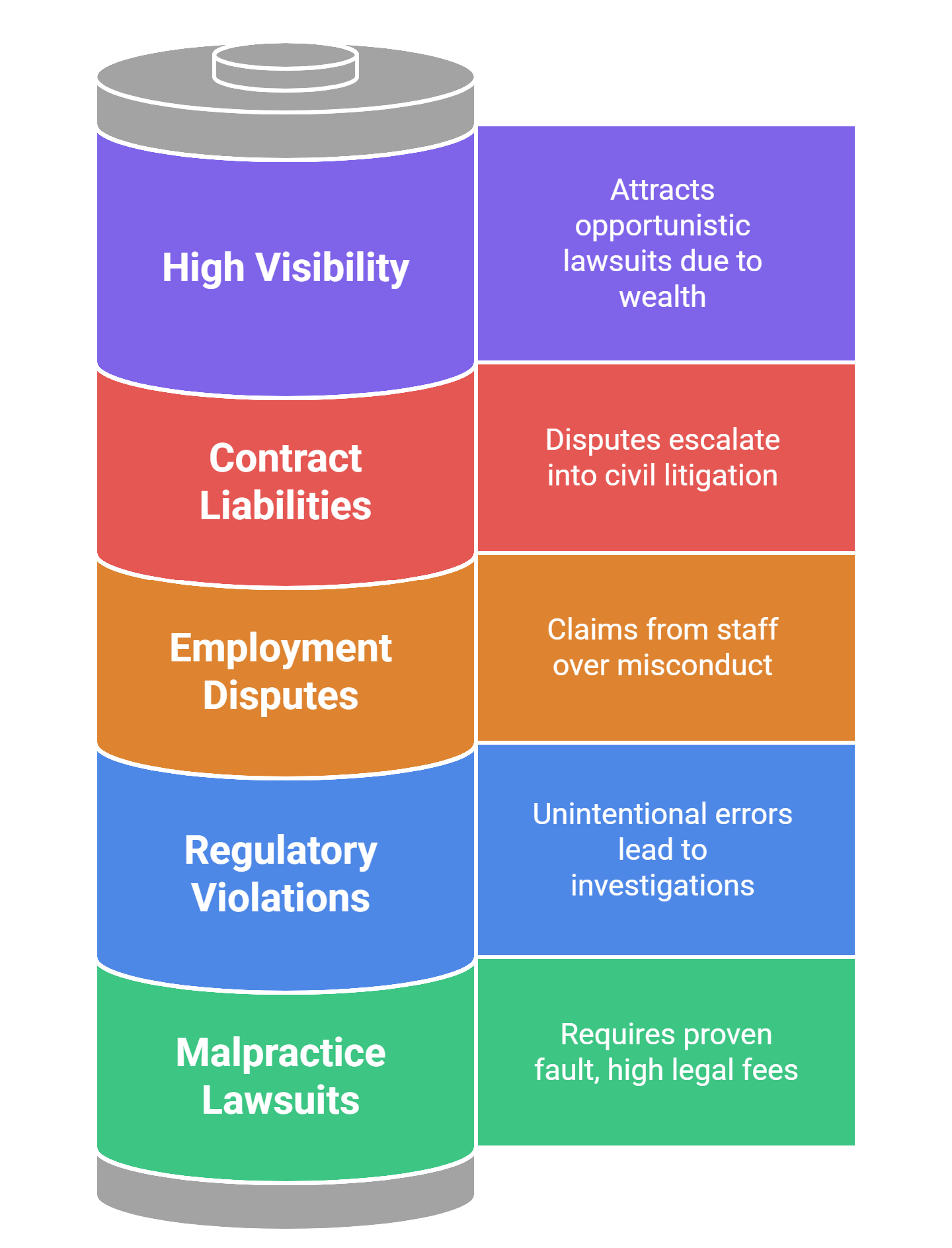

These typically include:

- Malpractice Lawsuits: Malpractice claims are a reality that all physicians must prepare for. The American Medical Association reports that approximately one-third of physicians in the United States will face a medical liability lawsuit during their careers. Even meritless claims cost thousands in legal fees and time away from practice.

- Regulatory Violations: Doctors must comply with HIPAA, Stark Law, and dozens of other regulations. A billing error or privacy breach, even if unintentional, can lead to government investigations, fines, or sanctions that threaten both practice and personal assets.

- High Visibility and Wealth: By age 55, the average family physician has accumulated over $1 million in net worth. Research shows that 82% of high-net-worth individuals report that their wealth increases their litigation risk. Physicians become attractive targets for opportunistic lawsuits from patients, employees, and unrelated parties.

- Employment and Contract Disputes: Practice owners may face claims from former staff over wrongful termination, wage disputes, or workplace issues. Business partnerships can sour, leading to expensive litigation that puts personal guarantees at risk.

In high-risk fields like surgery, OB-GYN, and emergency medicine, exposure is even greater. The cost of defending a claim, let alone paying a judgment, can be financially devastating. These factors make asset protection for doctors much more important.

Six Proven Asset Protection Strategies for Doctors

Many people assume that malpractice insurance is well-rounded enough to cover every base when considering asset protection for doctors. While malpractice insurance can cover lawsuits up to certain degrees, it may not always provide full coverage, particularly for large claims. When malpractice insurance only provides partial coverage, you face risks of asset seizure.

So, let’s look at six asset protection strategies for comprehensive, proactive coverage.

1. Asset Protection for Doctors Through Business Structures

The practice structure determines how liability flows in lawsuits. Proper business formation creates the first barrier between claims and personal wealth. Here are some popular options for asset protection through business structures:

Forming an LLC

A limited liability company (LLC) separates the business entity from the owner, so the owner cannot be held personally liable for debts collected against the business. For example, if a patient sues the practice for faulty equipment, your home, vehicles, and other assets would be safe from the debt collection process.

As with any other business structure, LLCs come with taxation and reporting requirements that your attorney can help you execute.

Key LLC benefits for doctors:

- Personal asset protection from business liabilities

- Flexible tax treatment options

- Simplified compliance compared to corporations

- Protection for multiple practice locations

Critical Requirements: You must maintain proper corporate formalities, keep personal and business finances separate, and avoid personal guarantees that could pierce the corporate veil.

Incorporating Your Practice

Forming a professional corporation (PC) or professional limited liability company (PLLC) can provide physicians with stronger internal protections, especially for group practices. These structures shield individual owners from liability tied to other physicians’ actions or administrative errors.

While incorporation does not protect against personal malpractice claims, it limits exposure to:

- Administrative errors

- Employee conduct lawsuits

- Contract disputes

- Partnership conflicts

PCs and PLLCs require strict compliance with state licensing requirements, annual filings, and corporate governance rules. The entity must operate as a true corporate structure to maintain protection.

2. Trust Strategies in Asset Protection for Doctors

Trusts are one of the most effective asset protection strategies for doctors. They create a legal separation between you and your assets, making it harder for creditors to reach them.

This separation is crucial for physicians who face above-average exposure to malpractice claims and regulatory actions.

Two types of trusts offer significant protection benefits: domestic asset protection trusts (APTs) and offshore trusts.

Domestic Asset Protection Trusts (APTs)

A domestic APT is an irrevocable trust that shields assets from future creditors while allowing you to benefit from trust assets. These trusts are recognized in certain U.S. states and provide protection without offshore complexity.

Benefits of Domestic APTs:

- Lower setup and maintenance costs than offshore trusts

- A familiar legal framework within the United States jurisdiction

- Potential tax advantages in certain states

- The grantor can remain a discretionary beneficiary

However, domestic APTs have limitations:

- U.S. courts can still reach into the trust in some cases.

- Limited protection in states that do not recognize APT statutes

- Timing restrictions prevent post-lawsuit formation

Vulnerable to federal tax liens and certain creditor claims

Asset protection trusts are most effective when set up well in advance, with strict compliance with state laws and careful trustee selection.

Offshore Trusts

Offshore trusts offer the highest form of protection as they allow you to create your legal structure outside of the U.S., where creditors typically cannot access your wealth because of jurisdiction boundaries. Domestic trusts can and have been seized, but offshore trusts created correctly and in the right location can guard your wealth in a legal, secure way.

The following are some popular jurisdictions for offshore trusts:

Benefits of Offshore Trusts for Doctors:

- Strong privacy laws prevent disclosure of trust details

- Foreign courts do not enforce United States judgments

- Short statutes of limitations in many jurisdictions make creditor claims difficult

- Assets, including real estate, investments, and cryptocurrency, receive immediate protection

Offshore trusts must comply with United States tax and reporting obligations. They require irrevocable structure, meaning you surrender legal ownership to the trustee.

Professional setup and ongoing management are essential for compliance and effectiveness. If you’re interested in setting up an offshore trust, you must work with an experienced asset protection attorney to ensure you create the document following all legal requirements across jurisdictions.

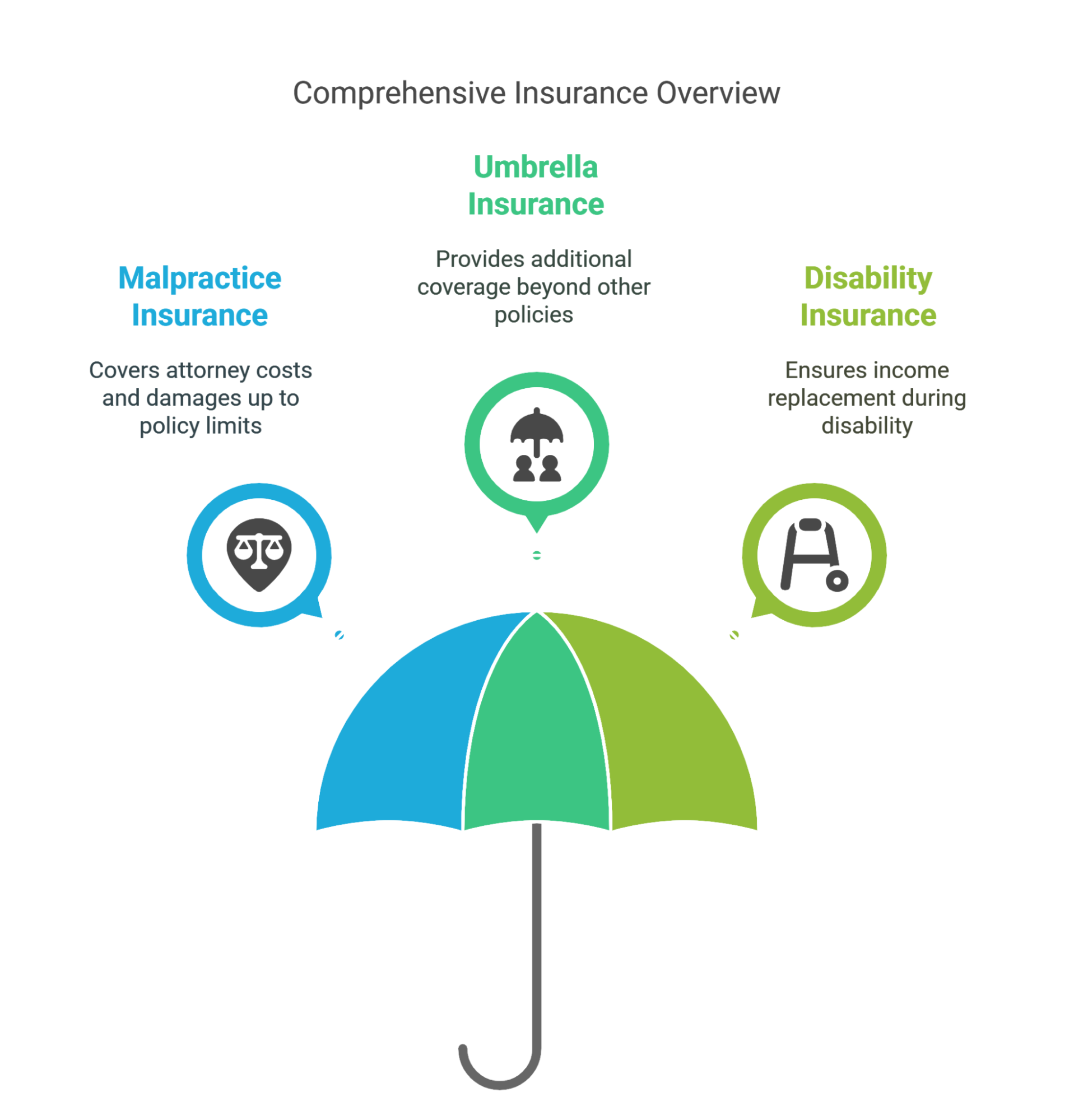

3. Insurance in Asset Protection for Doctors

While insurance may not offer 100% asset protection for doctors, healthcare professionals must keep this tool in their repertoire. Here are some common insurance options for your first line of defense:

Malpractice Insurance

Medical malpractice insurance acts as your initial defense during a lawsuit. Your plan will typically cover your attorney costs and any damages from the claim up to the maximum defined in your policy. Each state has varying minimum coverage requirements and maximum limitations for practitioners, typically ranging from around $1 million to several million.

With these limitations, your policy may not cover your full judgment. For example, say you are sued for $5 million, and the final judgment places you at $3.2 million. If your policy includes a maximum of $2 million in liability coverage, you would still owe $1.2 million, which now places your assets at risk.

Umbrella Insurance

Umbrella insurance kicks in when you’ve already exhausted the limitations of your other policies. This form of insurance can cover some types of lawsuits, injury claims, property damage, and more, providing an additional layer of coverage for your existing policies.

Disability Insurance

Disability insurance ensures you can receive income replacement if you cannot work because of an illness, injury, or disability. While this may not seem like a direct form of asset protection for doctors, it can safeguard your wealth from a financial hit during unforeseen accidents.

Similarly, many recommend documents like prenuptial agreements to prevent the financial losses that can occur during a divorce.

4. Retirement Accounts for Asset Protection for Doctors

Your retirement plan maximizes your future financial security and can offer some asset protection. In the event of a lawsuit, some of the wealth in your retirement accounts may be protected from seizure. Ultimately, the level of protection depends on account type and how much money the judge believes you need to live off of once you retire.

Popular Types of Retirement Accounts

Retirement accounts qualified under the Employee Retirement Income Security Act (ERISA) provide maximum protection against civil lawsuits, creditors, and bankruptcy. An ERISA-qualified plan must be maintained by an employer while complying with numerous federal rules. Examples include the following:

- 401(k)

- 419(a)(f)(6)

- HRAs

- FSAs

- HMOs

Self-funded plans, such as IRAs, provide less protection as they do not qualify for the ERISA. Even ERISA plans can be vulnerable to asset seizure during certain types of lawsuits or creditor claims, so it’s worth reading the fine print of your retirement plan to confirm either way.

Strategizing Your Retirement Plan for Maximum Protection

ERISA plans provide maximum protection, but you cannot rely solely on something like a 401(k) to protect all of your wealth. Instead, you should strategize with an asset protection attorney to develop the right plan for your needs. Your plan could involve a combination of offshore trusts, insurance, a 401(k), etc.

5. Estate Planning as an Asset Protection Strategy for Doctors

Trusts encompass just one form of estate planning and asset protection for doctors. Beyond this, you may want to consider the following:

Wills vs. Trusts

A will dictates where your wealth should go after you pass. The legal document does not provide any asset protection, but it can ensure that some of your end-of-life wishes are met. Trusts complement wills, ensuring that your belongings go to the correct beneficiaries without the requirements of long, complicated court proceedings like probate.

Healthcare Directives

Healthcare directives dictate your medical wishes in the event that you become incapacitated and can no longer communicate your preferences. The document can include structures like a healthcare proxy, which names a person who will make healthcare decisions, or a living will, which specifies treatment preferences.

While advance directives may not act as a form of asset protection, you may want to consider adding this document to your estate plan as you go through the process.

6. Financial Planning for Risk Management

Healthy financial planning can help you mitigate risks during unforeseen events. By building your wealth the right way, you will have a stronger foundation to stand on for maximum asset protection. Here are some basic tips, though you should meet with a financial advisor for personalized information:

Diversifying Your Investments

Diversifying your investments reduces risks, increases the opportunity for growth, and can provide insurance against asset seizures. With investment diversification, you invest in a range of asset classes. Rather than placing all of your wealth in overseas trusts, local real estate, ETFs, etc., you choose a mindful asset allocation strategy.

Asset diversification can protect you from financial losses if your stock or real estate market crashes while providing an extra buffer against creditors.

Debt Management

While debt management may not offer asset protection, poor debt management can directly lead to asset vulnerability. If you cannot properly manage your finances and fulfill payments, your assets can become vulnerable to debt collection. To avoid asset seizure from overdue debts, you must manage your debt carefully and employ the strategies above to protect your wealth.

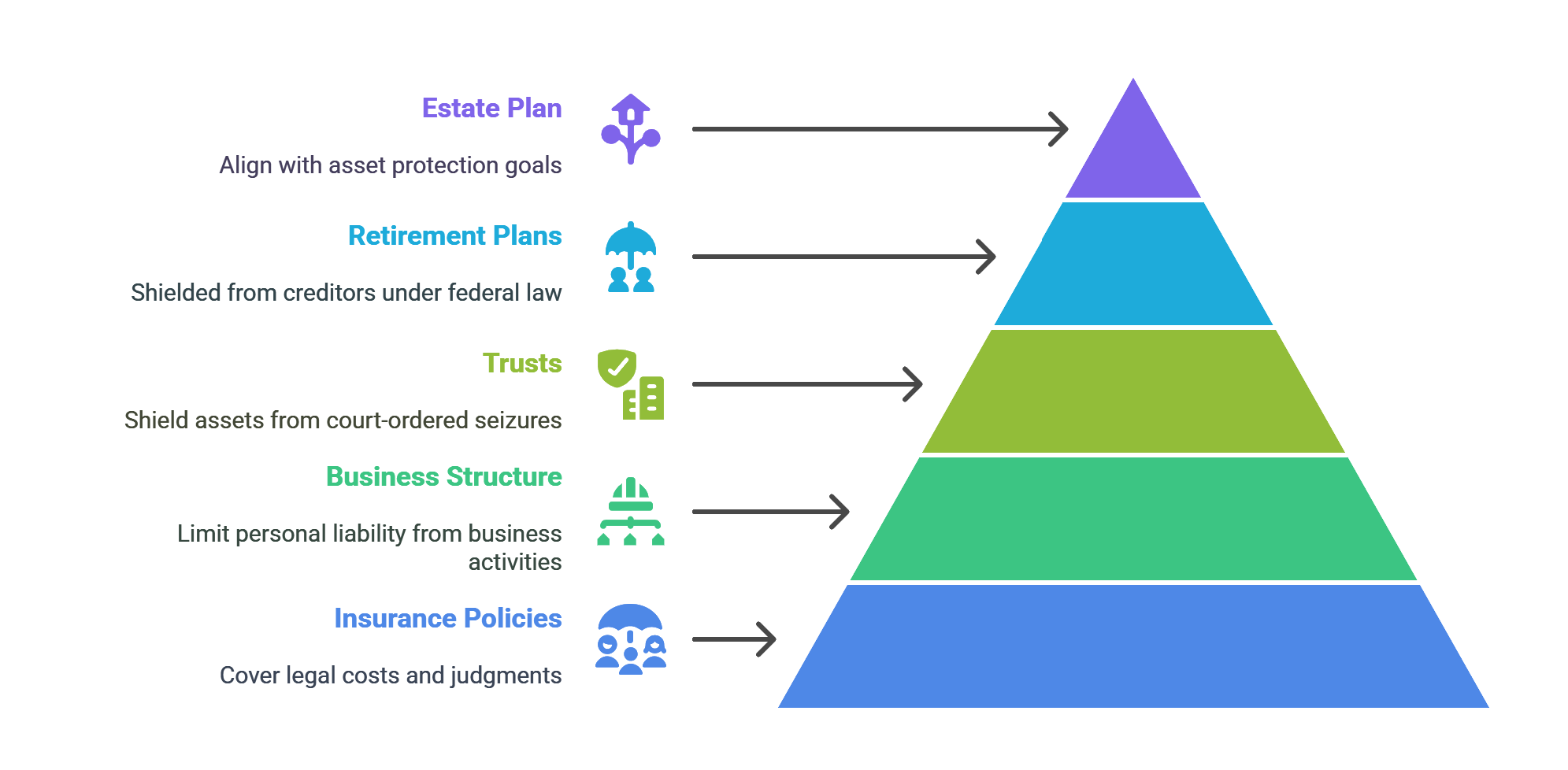

Layering Strategies for Stronger Asset Protection for Doctors

Many people assume that malpractice insurance or retirement accounts are enough to protect doctors from every financial threat. However, only one strategy rarely covers the full risk. The most effective asset protection for doctors comes from layering multiple strategies, each offering a different type of defense.

Here is how doctors can combine these tools to create a more robust shield:

- Start with Solid Insurance: Malpractice and umbrella policies are your first line of defense. They help cover legal costs and judgments, reducing immediate financial exposure.

- Add Business Structure Protection: Form LLCs or professional corporations to separate business liabilities from personal assets. Proper entity structure prevents practice claims from reaching personal wealth.

- Use Trusts for High-Value Assets: Place real estate, cryptocurrency, or investment accounts in domestic or offshore trusts. These legal entities remove ownership from your name, shielding assets from court-ordered seizures.

- Build Protected Retirement Plans: Contribute to ERISA-qualified accounts (like 401(k)s), which are often shielded from creditors under federal law.

- Secure Your Estate Plan: Ensure your will, trusts, and directives align with your asset protection goals. Trust-based estate plans can prevent costly probate exposure and preserve privacy.

The key is not to rely on one solution. By layering these legally sound strategies, doctors can stay ahead of threats and protect the wealth they have worked years to build.

Why Advance Planning Matters for Doctor Asset Protection

Once legal claims are filed, protection options become severely limited. Courts can freeze assets, prevent transfers, and reverse post-claim transfers. Effective asset protection for doctors only works when done in advance.

Here is why:

- Limited Time: Trusts and LLCs require time to be enforceable. Courts examine intent and timing. Protection structures must be in place long before a threat arises to be respected.

- Limited Insurance Coverage: Insurance policies have coverage limits. Malpractice insurance often covers only a portion of large judgments. Excess liability remains a personal risk.

- Strict Legal Requirements: Asset protection must comply with the law. Structures must be legally sound. Attempting to move or shield assets during litigation may violate fraud and transfer laws.

- Jurisdictional Barriers Take Time: Offshore trusts, especially in jurisdictions like the Cook Islands or Nevis, require meticulous setup and legal compliance. These structures are only effective if established well in advance.

- Retirement Account Protections Are Not Absolute: While ERISA-qualified plans offer protection, non-qualified accounts like IRAs may still be vulnerable. Proper structuring and diversification must be done before threats emerge.

- Estate Planning Requires Coordination: Trusts, wills, and healthcare directives must be aligned and updated regularly. Courts often challenge outdated or inconsistent documents, especially during disputes.

A proactive strategy ensures that wealth accumulated over decades remains legally shielded from lawsuits, creditors, or regulatory action, without having to rely on last-minute fixes that courts may ignore.

Advanced Asset Protection Considerations for Doctors

High-net-worth physicians may need additional protection strategies beyond basic planning. Complex asset portfolios and higher risk exposure require sophisticated legal structures.

Multiple Trust Strategies

Doctors with substantial wealth often benefit from multiple trust structures, each serving specific purposes:

- Family Protection Trusts: Shield family residence and personal assets from professional liability claims while maintaining beneficial use.

- Investment Trusts: Hold cryptocurrency, securities, and alternative investments in offshore jurisdictions with strong privacy laws.

- Retirement Trusts: Supplement ERISA protection with additional offshore structures for excess retirement savings.

International Considerations

Doctors with international practices, investments, or family connections may need cross-border planning. Foreign income, assets, and business interests require specialized compliance and protection strategies.

Professional Practice Succession

Asset protection planning must coordinate with practice succession and exit strategies. Proper planning ensures protection continues through practice sales, partnership changes, and retirement transitions.

Choose Blake Harris Law for Asset Protection Tailored to Doctors

At Blake Harris Law, we offer custom, extensive asset protection specifically designed for doctors. Our experienced attorneys understand the unique financial and legal risks that come with practicing medicine and offer proven strategies to shield your wealth.

With our iron-clad offshore protection trusts, you can enjoy complete peace of mind. We have extensive knowledge and experience in developing trusts in secure jurisdictions around the world.

Do not leave your wealth at risk for one more day. Contact Blake Harris Law today to secure your assets.