Quick Summary

Understanding how garnishment works is key to protecting your funds. This article explains the legal process of bank account garnishment, how it applies to online banks, what types of income may be protected, and the steps you can take to safeguard your assets before a creditor acts. For more insights on protecting your assets, explore the Blake Harris blog.

Worried About Creditors Targeting Your Online Bank Account?

With the popularity of digital banking, many people assume that online bank accounts offer an extra layer of protection from debt collectors.

But can an online bank account be garnished? The short answer is yes. Whether funds are held in a traditional institution or a digital-only bank, they are not immune to legal claims.

In this Blake Harris Law article, we explain how garnishment works, when and how online accounts can be targeted, and what steps you can take to limit legal exposure.

Why Listen to Us?

We focus exclusively on asset protection, helping high-net-worth clients protect their wealth from lawsuits and legal claims. With deep experience in structuring legal tools like offshore trusts in Cook Islands, Nevis, and Belize, this guide reflects the same strategies we use to help clients prepare before financial trouble leads to bankruptcy or legal exposure.

What is Bank Account Garnishment?

Bank account garnishment is a legal process that allows creditors to withdraw money directly from a person’s bank account to recover unpaid debts. This usually happens after a court judgment has been entered against the account holder.

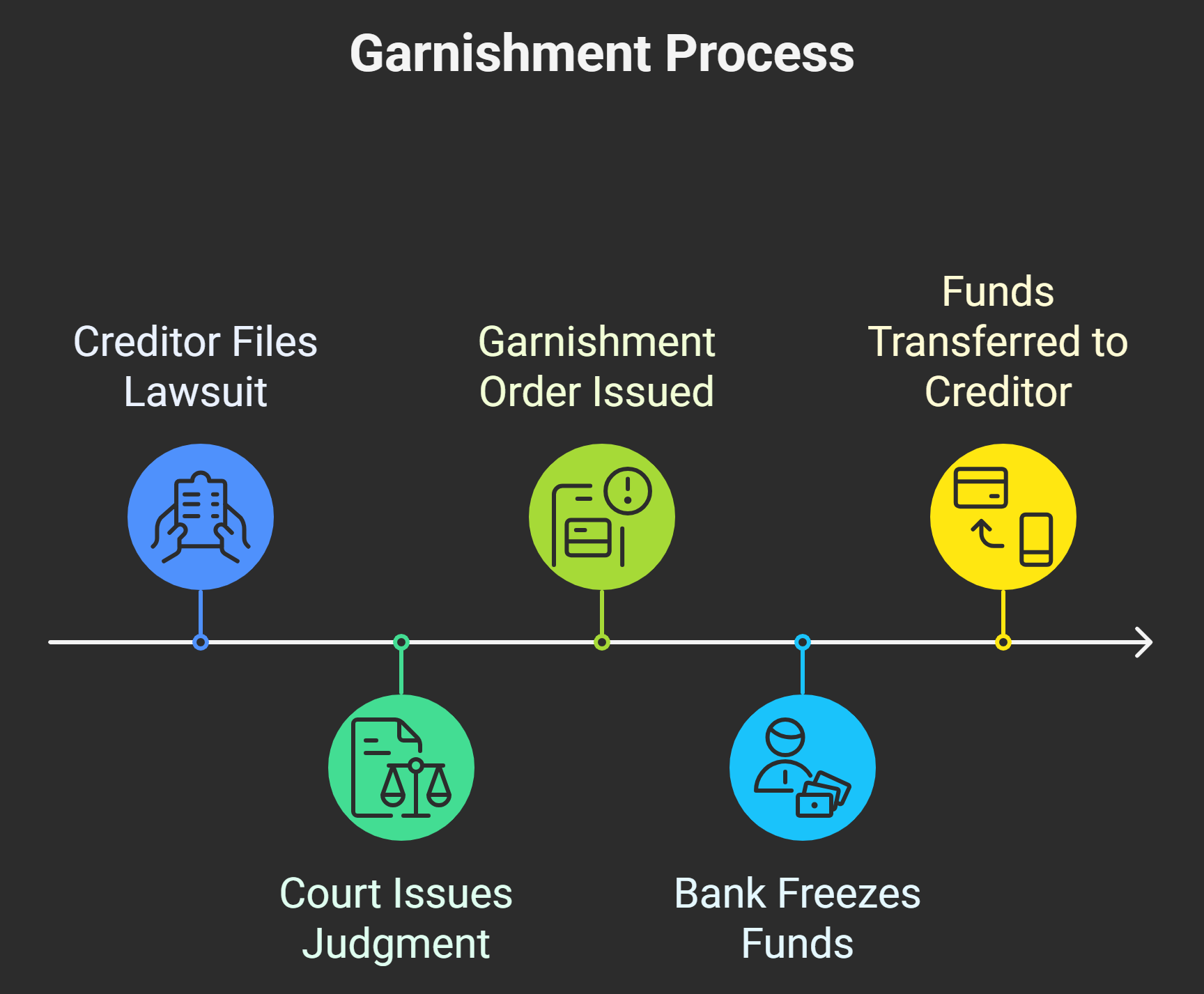

Here is how it works:

- A creditor files a lawsuit and obtains a judgment

- The court issues a garnishment order to the bank

- The bank freezes funds up to the amount owed

- Those funds are then transferred to the creditor

Does this Apply to Online Bank Accounts?

Yes. Garnishment applies to both traditional and online bank accounts. As long as the account is held at a U.S. based financial institution, it can be legally targeted through a court order. Online-only banks must comply with the same garnishment laws as brick-and-mortar institutions.

Can Online Accounts Be Garnished Without Court Orders?

Yes. Certain government agencies have the authority to garnish accounts without first obtaining a court order.

- The IRS can levy bank accounts for unpaid federal taxes after issuing a final notice and giving the taxpayer a chance to request a hearing.

- State child support agencies can collect past-due support through administrative garnishment.

- The Department of Education can garnish wages for defaulted federal student loans, provided it follows required notice and dispute procedures.

These actions must comply with strict administrative rules and due process requirements, but they apply equally to online and traditional bank accounts.

Are there any Limitations, Exemptions, or Protected Funds?

Unlike wage garnishment, which is limited by federal law, bank account garnishment does not have a nationwide cap. Once a creditor obtains a court judgment, they may levy the full amount owed, potentially freezing or seizing all non-exempt funds in the account.

However, several types of income are protected under federal and state law. These laws are designed to ensure you retain access to basic living expenses, especially if your income comes from protected sources.

Federal Protections

Certain federal benefits are protected from garnishment if directly deposited into a bank account or prepaid card. According to the Consumer Financial Protection Bureau, the following benefits are exempt from most creditor claims:

- Social Security and Supplemental Security Income (SSI)

- Veterans’ and military service benefits

- Federal student aid

- Military retirement and survivor benefits

- Civil service and federal retirement or disability payments

- Railroad retirement benefits

- FEMA disaster assistance

When a financial institution receives a garnishment order, it must review the account for federal benefit deposits made in the previous two months. Up to two months of these benefits are automatically protected from garnishment.

NOTE: If benefits are deposited by check or moved between accounts, automatic protection may not apply. In such cases, you must file a claim of exemption to prevent those funds from being transferred.

Exceptions to Federal Exemptions

Some government agencies may garnish certain federal benefits without a court order:

- The IRS may withhold up to 15% of Social Security benefits for unpaid federal taxes.

- The Department of Education can garnish benefits for defaulted federal student loans.

- Child support and spousal support orders may override standard exemptions.

These actions are conducted through administrative offset or levy procedures and are subject to legal safeguards.

State-Level Garnishment Protection

Many states provide additional protections, including:

- A minimum protected balance in your bank account

- Exemptions for recent wage deposits

- Protection for disability, unemployment, child support, or alimony (varies by state)

For instance, New York protects the first $3,600 in a consumer’s bank account from garnishment. Other states may exempt a portion of recent income or specific benefit types.

Does Bankruptcy Stop Online Bank Account Garnishment?

Yes. Filing for bankruptcy triggers an automatic stay that immediately stops most collection efforts, including garnishment of online bank accounts.

This protection applies to both traditional and digital banks. However, garnishments for child support, alimony, or certain tax debts may still proceed under specific legal exceptions.

How to Protect Your Online Bank Accounts from Garnishment

- Keep Exempt Funds Separate: Maintain protected income, such as Social Security or veterans’ benefits, in dedicated accounts. This helps preserve automatic protections and avoids complications when asserting exemptions.

- Do Not Commingle Funds: Mixing exempt and non-exempt funds can weaken legal protections. Keeping them separate strengthens your position if your account is targeted.

- Use Legal Structures for Asset Protection: Asset protection tools, such as limited liability companies (LLCs) or properly structured trusts like Cook Islands Trust, Nevis Trust, and Belize Trust, can provide an additional layer of defense.

- Consult a Legal Professional: Work with an asset protection attorney. At Blake Harris Law, we can help you set up compliant structures and respond to creditor actions within the bounds of the law.

Shield Your Online Accounts with Blake Harris Law

Online bank accounts offer convenience, but not protection from garnishment. If a creditor obtains a judgment, they can access funds in digital accounts just as easily as in traditional banks. That is why proactive asset protection is important.

At Blake Harris Law, we help clients protect vulnerable bank accounts through strategic legal planning. Whether you need to safeguard exempt income or structure trusts that meet legal standards, our team designs solutions tailored to your risk profile.

We can help you;

- Preserve exempt income such as Social Security or VA benefits

- Avoid fund commingling that undermines exemption claims

- Use legal structures to protect high-risk assets from future claims

Secure what matters, Contact our team to take the first step in protecting your wealth.