Quick Summary

This article explains when trust assets are protected, how IRS doctrines like nominee and alter ego apply, and why proper structuring is critical. Learn how to avoid costly mistakes and safeguard your assets with a legally sound trust strategy. Find more insights on asset protection strategies in our articles.

Want to Know If the IRS Can Seize an Irrevocable Trust?

The short answer is yes, but only under specific conditions. While irrevocable trusts are commonly used to preserve financial privacy and protect assets, their effectiveness depends on how they are structured and administered.

This Blake Harris Law article breaks down when and how the IRS can reach trust assets, what factors determine vulnerability, and how proper planning can limit risk.

Why Listen to Us?

We focus exclusively on asset protection, including offshore and crypto asset protection structures. We have helped high-net-worth clients legally shield assets from creditors and government claims. Our firm brings real-world experience in establishing compliant, effective irrevocable trusts tailored to each client’s unique financial goals.

Understanding Irrevocable Trusts

An irrevocable trust works by permanently transferring ownership of your assets into the trust, and removing them from your personal estate. This structure limits exposure to creditors, lawsuits, and, in many cases, IRS claims.

Unlike revocable trusts, you relinquish control, which strengthens protection. This makes irrevocable trusts a practical option for individuals in high-risk professions. However, due to their complexity, proper legal guidance is key when setting up an irrevocable trust. For a deeper understanding of irrevocable trust structures, review our full guide here.

Can the IRS Seize Assets In a Properly Structured Irrevocable Trust?

Generally, the IRS cannot seize assets held in a properly structured irrevocable trust. A properly structured trust is one where the grantor fully relinquishes ownership, control, and beneficial interest, and the trust is administered independently in compliance with applicable laws.

This legal separation removes the assets from the grantor’s personal estate, making them generally protected from personal creditors, including the IRS. However, there are some important exceptions.

Exceptions: When the IRS Can Access Trust Assets

There are situations where the IRS may still reach trust assets.

1. Grantor Retains Control

If the grantor keeps certain powers or benefits, such as:

- The ability to revoke the trust

- The ability to control or direct distributions

- The right to receive trust income

The IRS may classify the trust as a grantor trust, making the assets part of the grantor’s taxable estate and subject to IRS claims.

2. Trust Treated as a Facade

The IRS uses the nominee and alter ego doctrines to pursue tax liabilities when it believes a taxpayer is using entities like irrevocable trusts to shield assets while retaining control.

- Nominee Doctrine: Applied when assets are titled in the name of another person or entity, but the taxpayer:

- Continues using the property

- Pays expenses related to it

- Has a close relationship with the titleholder

In such cases, the IRS may treat the other party as holding assets on behalf of the taxpayer and pursue collection.

- Alter Ego Doctrine: Used when the trust and taxpayer are so intertwined that they are essentially the same. Indicators include:

- Commingled personal and trust finances

- Lack of independent trustees

- Continued control of trust assets by the grantor

If established, the IRS may disregard the trust’s legal form and levy its assets.

Spendthrift Provisions Don’t Block the IRS

Spendthrift provisions are clauses within a trust designed to prevent beneficiaries from assigning their interest or allowing creditors to access trust assets before distribution.

Even when a trust includes these protections, the IRS can still intervene. If a beneficiary has a right to receive income or distributions, the IRS may levy those payments, despite state law protections. This is because federal tax liens supersede spendthrift protections under state law.

Tax Considerations: Step-Up in Basis

The step-up in basis allows inherited assets to be revalued at their fair market value on the date of the grantor’s death. This can significantly reduce or eliminate capital gains tax when those assets are later sold by beneficiaries.

However, under IRS Revenue Ruling 2023-2, assets held in certain irrevocable grantor trusts that are excluded from the grantor’s taxable estate do not receive a step-up in basis. In these cases, heirs may face capital gains taxes based on the original purchase price.

Here is an example:

Suppose a grantor places $1 million in appreciated stock into an irrevocable trust. The stock was originally purchased for $200,000. If the trust is structured to keep the stock outside the grantor’s taxable estate, and the beneficiary later sells it after the grantor’s death, they will owe capital gains tax on the $800,000 gain.

If the trust had been structured to include the stock in the estate, the basis would reset to $1 million, eliminating that tax liability.

This ruling highlights a key trade-off:

- Excluding assets from the estate may offer creditor protection

- Including assets in the estate may preserve tax benefits for beneficiaries

To avoid unintended tax consequences, you should structure the trust with both protection and tax efficiency in mind. Working with a qualified asset protection attorney like Blake Harris Law can help achieve the right balance.

Best Practices for Asset Protection in Irrevocable Trusts

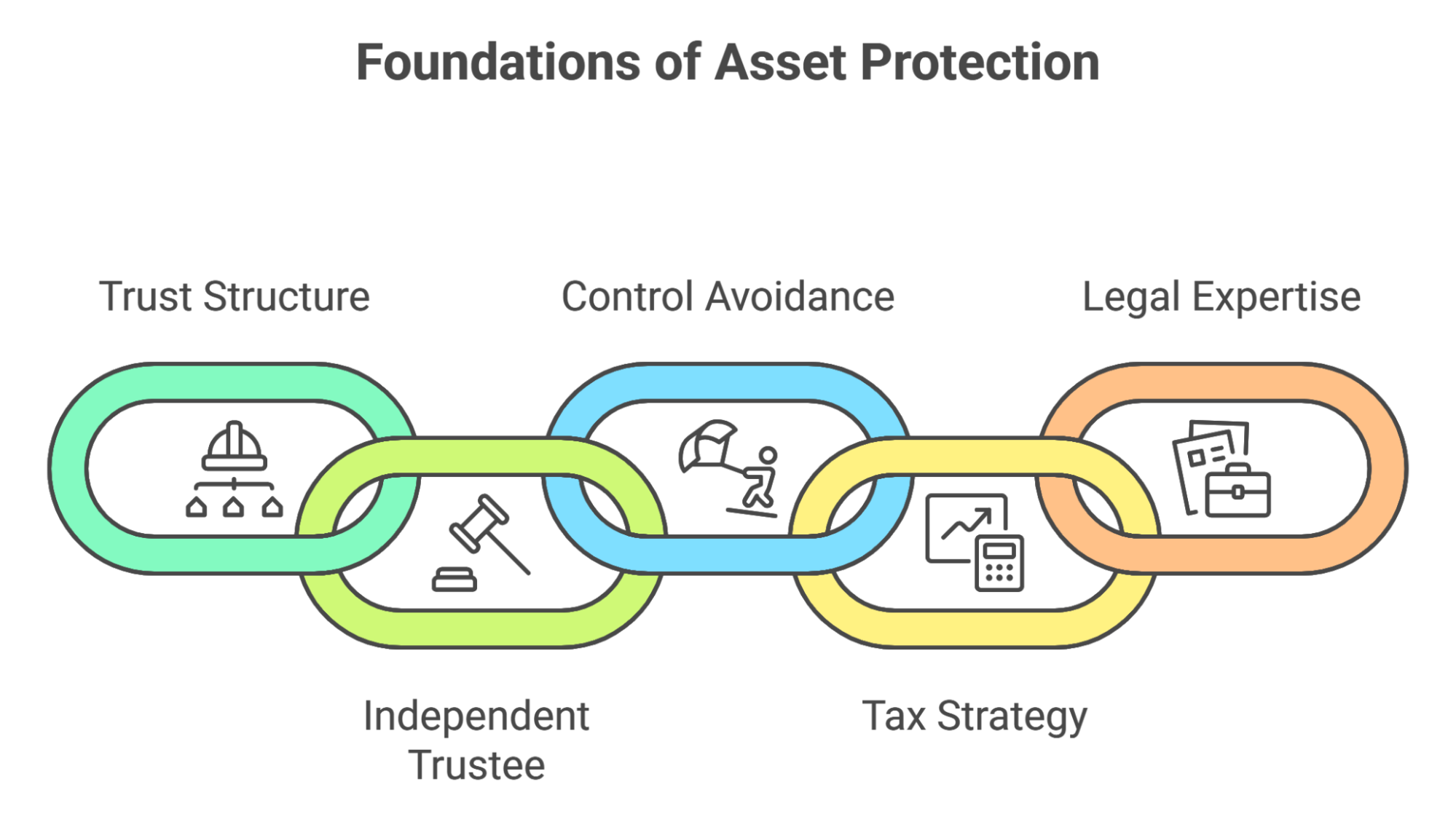

Choose the Right Trust Structure

Select a trust that aligns with your goals. Offshore trusts in the Cook Islands, Nevis, or Belize provide strong legal protections. Domestic Asset Protection Trusts (DAPTs) and Irrevocable Life Insurance Trusts (ILITs) may also be suitable, depending on your needs.

Appoint an Independent Trustee

Use a trustee who is not the grantor or a close family member. Independent administration reinforces legal separation and helps prevent the trust from being challenged as a sham or alter ego.

Avoid Retaining Control

The grantor should not have the power to revoke the trust, control distributions, or benefit personally from the assets. Retaining control may expose the trust to IRS claims or legal challenges.

Balance Asset Protection with Tax Strategy

Understand the tax implications of your trust design. Under IRS Revenue Ruling 2023-2, excluding assets from the taxable estate may forfeit the step-up in basis, increasing capital gains for heirs. Proper planning can reduce this risk.

Work with an Experienced Asset Protection Attorney

Trust law is complex, and small mistakes can compromise protection. An asset protection attorney can help structure the trust properly, select the right jurisdiction, and ensure long-term compliance with applicable laws.

Take Control of Your Trust Strategy Today

An irrevocable trust can offer meaningful protection from IRS claims, but only when structured properly. Missteps like retaining control or overlooking key tax rules can leave assets vulnerable and burden heirs with avoidable tax consequences.

Blake Harris Law helps high-net-worth clients create legally sound, strategically designed irrevocable trusts. Our focus is asset protection. We work across jurisdictions like the Cook Islands, Nevis, and Belize to build trust structures that safeguard your wealth and preserve your legacy.

Protect what you have built, contact Blake Harris Law to learn how we can help.