Quick Summary

Many states have laws that protect assets from creditors through the use of irrevocable trusts, and Nevada is one of them. This Blake Harris Law guide examines the legal framework for Nevada Asset Protection Trusts, their strengths and limitations, as well as general guidance on alternative strategies.

Need to Protect Your Assets Under Nevada Law?

According to Pew Research, U.S. state courts handle about 66 million cases each year. Many involve creditor claims, business liabilities, or other financial disputes.

If you’re a wealthy individual, your estate is constantly exposed to risks from lawsuit judgments. You need asset protection planning, and Nevada stands out as one of the best asset protection states.

In this guide, we’ll explain how a Nevada Asset Protection Trust works to legally shield your assets from creditor claims.

Why Listen to Us?

Our asset protection attorneys at Blake Harris Law have decades of combined experience handling both domestic and offshore asset protection. We provide strategic trust planning aligned with evolving Nevada statutes to help clients structure trusts that safeguard their wealth in the long term.

What is a Nevada Asset Protection Trust?

An asset protection trust (or spendthrift trust) is a legal setup where you give another person or institution the right to hold and manage your assets for the benefit of a third party.

The Nevada Asset Protection Trust is an irrevocable trust created under Nevada’s Domestic Asset Protection Trust (DAPT) statutes and governed by U.S. law. It offers strong protection against creditors for assets inside the United States.

While trust assets are no longer legally yours, Nevada law allows you to be both the grantor and a beneficiary. However, this provision also has the capacity to weaken your trust’s protections.

How Does a Nevada Asset Protection Trust Work?

To put it simply, a Nevada Asset Protection Trust creates a legal boundary between you and your wealth.

For example, imagine you own a successful business and several investments. However, the constant risk of lawsuits and creditor claims threatens what you’ve worked hard to build.

In four steps, you can set up a Nevada Assets Protection Trust:

- Consult an attorney: Work with an asset protection attorney to draw up a strategy and gather the required documentation

- Create the trust: Establish the trust per your specifications, following Nevada law

- Transfer assets: Legally sign over ownership of selected assets to the trust

- Maintain compliance: Follow mandatory provisions and wait out the statute of limitations

After establishing an asset protection trust, there is a timeframe within which your creditors can challenge the transfer of those assets. It is called the statute of limitations and varies between DAPT states.

In Nevada, the statute of limitations for spendthrift trusts is 2 years. Pre-existing creditors get a shorter time period based on when they discover an asset transfer.

For instance, you create and fund a Nevada Asset Protection Trust on January 1st, 2025. Someone who becomes your creditor later in the year would have until January 1st, 2027, to make a fraudulent transfer claim. However, if you already owe someone before creating the trust, they have 6 months from the date they discover the transfer.

While the Nevada Asset Protection Trust is irrevocable, it gives you some wiggle room to legally:

- Receive distributions or income from the trust

- Hold the power to change beneficiaries in the future

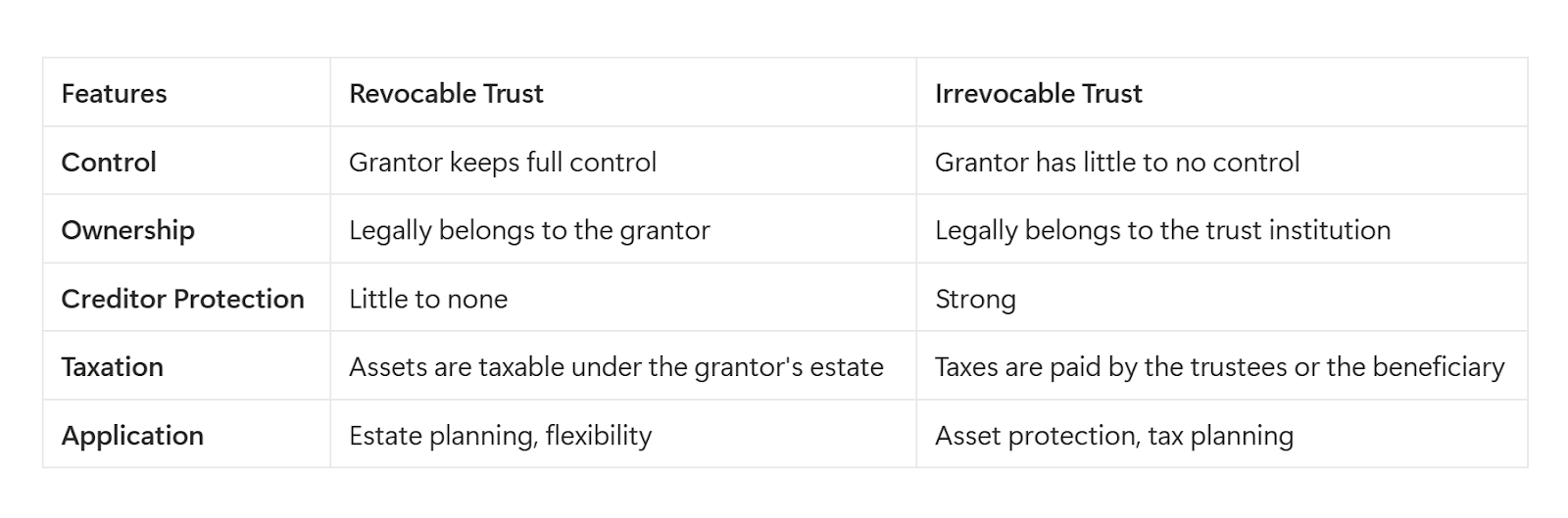

Nevada Asset Protection Trust Vs. Revocable Trusts

Traditional revocable trusts are established to streamline estate management and inheritance, rather than protect assets. They ensure that when the grantor dies, the assets pass to the heirs as outlined in the trust.

Assets in revocable trusts remain under the ownership and control of the grantor, so you can pull them out, change beneficiaries, or dissolve the trust at will. On the other hand, irrevocable trusts, such as the Nevada Assets Protection Trust, require the grantor to relinquish lifetime ownership rights to the assets.

Here’s how irrevocable and revocable trusts compare:

Legal Frameworks That Govern Nevada Asset Protection Trusts

Wondering what laws shape the protections of a Nevada spendthrift trust?

‘Choosing the right DAPT jurisdiction requires careful knowledge of each state’s laws, their unique features, and the state’s experience with asset protection trusts’ —Domestic Assets Protection Trust: A Practice and Resource Manual

The (NRS) 166 – Spendthrift Trust Act of Nevada — outlines rules for creating and enforcing self-settled Nevada Asset Protection Trusts. Its key provisions include:

1. Creditor Limitations

Statute of Limitations

According to NRS 166.170(1), a creditor can only challenge a transfer to a Nevada spendthrift trust within two years of the transfer (or six months from discovery for pre-existing creditors—whichever is later).

Burden of Proof

To challenge an asset transfer, NRS 166.170(3) requires a creditor to prove by clear and convincing evidence that it was fraudulent or violates a legal obligation owed to the creditor under a valid contract or court order.

2. Mandatory Provisions

With Grantor as Beneficiary

As outlined in NRS 166.040(1), anyone legally able to make a will or deed can set up a spendthrift trust, provided it is irrevocable, can’t force benefits to the grantor, and isn’t intended to cheat or delay known creditors.

Permitted Powers of Grantor

According to NRS 166.040(2), the grantor can keep some rights without invalidating the trust. They may be able to:

- Prevent a distribution

- Appoint future beneficiaries, as long as they don’t choose themselves

- Receive benefits from the trust at the discretion of the distribution trustee

- Use trust assets like cars or houses

Prohibited Powers of Grantor

The grantor has only the rights detailed in the trust document. NRS 166.045 invalidates any formal or informal agreements to give the grantor more control.

3. Notification Requirements

Nevada law doesn’t require the grantor to notify anyone when creating a spendthrift trust. According to NRS 166.170(2), recording the transfer publicly (such as a property deed at the county recorder’s office) or filing financing statements constitutes public ‘discovery.’

4. Affidavit of Intent

Under NRS 166.040(1)(b), a trust must not be created to cheat existing creditors. As a result, moving assets into a trust after incurring debts or getting sued may be deemed fraudulent.

However, Nevada law doesn’t require an official affidavit of intent when creating a trust.

5. Asset Protection Restrictions

The NAPT does not protect assets that have been proven to be fraudulent transfers. If you use trust assets as loan collateral, NRS 166.170(4) states that the lender’s mortgage or deed of trust remains valid and can be enforced against the trust.

6. Trustee Guidelines

Requirements

For self-settled trusts (where the grantor is also a beneficiary), NRS 166.015(2) mandates that at least one trustee must be:

- A person living in Nevada

- A trust company with an office in Nevada, or

- A bank in Nevada legally allowed to manage trusts

Powers and Duties

Per NRS 166.120(4), the trustee must reject or block any action that goes against the Nevada Spendthrift Trust law.

For example, if someone tries to go after a beneficiary’s rights or seize trust assets, they must file a case following Nevada’s laws for living spendthrift trusts, and only the court can decide on these matters(2).

Advantages of Nevada Asset Protection Trusts

According to the Domestic Assets Protection Trust: A Practice and Resource Manual, the statute of limitations on creditor claims is one of the key factors in choosing a DAPT.

Under the Uniform Fraudulent Transfer Act (UFTA), the period of limitations was four years across most U.S. jurisdictions. However, since DAPT states recognized that shorter limitation periods attract more trust business, it has become a competition of ‘how low can you go?‘

Since 1999, Nevada has passed favorable DAPT laws, including one of the shortest statutes of limitations in the country.

Let’s take a closer look at this jurisdiction’s strengths.

1. No Exception Creditors

Unlike most DAPT jurisdictions, Nevada makes no exception for statutory creditors, such as a divorcing spouse. NRS 166.090(1) prohibits child and spousal support orders from being enforced against a spendthrift trust if the obligations were not known at the time the trust was created.

2. Two-Year Period of Limitations

There’s only a two-year wait period before assets in a Nevada Assets Protection Trust are fully protected from creditors.

3. Co-Trustee Rights

A NAPT has three trustees for investment, distribution, and administration. Under NRS 166.040(3), a grantor can also serve as the investment trustee, managing what and when the trust buys or sells.

4. Protection for Partnerships and LLCs

If someone owes money and owns part of an LLC or partnership under a NAPT, NRS 86.401(2)(a) prohibits the debtor’s creditor from touching the company’s assets. They can only get a charging order, which entitles them only to the debtor’s payouts from the business.

5. No State Income Tax

Nevada is one of the few states with no taxation laws on trust income. Assets that you move into an NAPT are automatically no longer part of your taxable estate.

Disadvantages of Nevada Asset Protection Trusts

A Nevada spendthrift trust still presents a few limitations to grantors. They include:

1. Irrevocability

According to NRS 166.040(1)(b), the grantor loses direct control over trust assets and cannot decide to modify terms, retrieve assets, or dissolve the trust at will.

2. Trustee Requirements

For self-settled trusts, at least one of the three trustees must live in or have an office in Nevada. This can present a challenge to grantors who live outside Nevada, as qualified, independent trustees are both costly and scarce.

3. Limited Creditor Protection

An NAPT does not protect assets immediately from existing creditors. It is not suitable for individuals facing immediate litigation risk or seeking reactive asset protection.

4. Federal Bankruptcy Override

If you file for bankruptcy within 10 years of creating a Nevada Assets Protection Trust, a bankruptcy trustee may be able to override Nevada’s two-year statute of limitations and challenge transfers under federal law.

11 U.S.C. § 548(e)(1) provides a ten-year look-back for transfers to self-settled trusts if the trustee can prove the transfer was made with actual intent to hinder, delay, or defraud creditors.

Out-of-State Assets

Not all states recognize domestic asset protection trusts, so if your assets (especially real estate) are not in Nevada, they may not be protected by an NAPT. Under NRS 166.015(1), assets in non-DAPT states may be subject to the laws of those states instead.

Key Considerations for a Nevada Asset Protection Trust

What Assets Can a NAPT Protect?

Nevada spendthrift trusts protect almost any kind of asset, including:

- Real estate

- Cash

- Bank accounts

- Cryptocurrency

- LLC membership interests

- Business shares

- Intellectual property —patents, copyrights, trade secrets, trademarks

Must You be a Nevada Resident?

No, you must not. From international businesses to foreign nationals, anyone can set up a Nevada spendthrift trust. The only provision is that if you’re also a beneficiary of the trust, at least one trustee must be a Nevada resident, a Nevada trust company, or a qualified Nevada bank.

Even if creditors pursue claims against your assets in a different state’s court, a Nevada Asset Protection Trust will still stand until they can prove the transfer was fraudulent.

Does an NAPT Protect Out-of-State Assets?

Protecting real estate outside Nevada with a NAPT can be challenging, as not all states adhere to the Uniform Trust Code provisions that recognize Domestic Asset Protection Trusts.

If you have assets in one of such states (like California), a creditor in that state could still win a judgment against your Nevada spendthrift trust. Consult an asset protection attorney to identify strategies that can protect out-of-state properties.

Should the Grantor Also be a Beneficiary?

While Nevada law allows a grantor to be one of the beneficiaries of a Nevada Asset Protection Trust (NAPT), experience and case law show that assets are safer when the grantor is not a beneficiary.

The more control a grantor retains, the easier it is for creditors to claim the trust was created to avoid debts and U.S. courts have sometimes disregarded such trusts.

Most attorneys advise transferring assets to the trust without keeping any beneficial interest. To protect assets while retaining benefits, you may want to explore offshore alternatives.

Alternatives to Nevada Asset Protection Trusts

Wealthy individuals and high-risk professionals (like surgeons, lawyers, or contractors) may want stronger protections than domestic trusts can offer. Let’s explore some options.

Offshore Trusts

An offshore trust is created under foreign laws, placing it outside the jurisdiction of the grantor’s home country.

Offshore trusts offer flexible spendthrift provisions, making it harder for creditors to reach assets, even with a U.S. court judgment. However, you need to weigh your options and choose a favourable offshore trust jurisdiction.

Three top options are:

- The Cook Islands

- Belize

- Nevis

1. Cook Islands Trusts

After passing its International Trust Act in 1989, the Cook Islands has become a leading offshore trust jurisdiction. To meet legal requirements and ensure protection, grantors partner with trustees and trust companies based in the Cook Islands with no ties to the US.

While Cook Islands trusts cost more to set up and maintain than domestic options, their flexibility and stronger privacy protections make them a worthwhile investment.

2. Belize & Nevis Trusts

Belize and Nevis trusts are popular alternatives to the Cook Islands offshore trusts because they offer:

- quick setup

- flexible cost

- strong legal protections

A Belize or Nevis trust is a good option if you’re looking to balance cost with urgency. Like all offshore trusts, they come with limitations, so the benefits depend on your specific situation.

Limited Liability Companies (LLCs)

A limited liability company protects assets from business liabilities and vice versa through two key mechanisms:

- Limited liability protection: Legally separates your personal and business assets (corporate veiling) so that creditors cannot reach your home or savings for business debts.

- Charging order protection: Protects the LLC’s assets from claims against individual owners. Personal creditors can only obtain a charging order to receive distributions that would otherwise be made to you.

Cook Islands LLCs

While LLCs provide a degree of protection, registering them overseas offers maximum protection for your assets. Cook Islands LLCs offer:

- Stronger asset protection: The Cook Islands law heavily favors the grantor, only allows charging orders against Cook Islands LLCs, and does not recognize judgments from overseas courts. Therefore, a U.S. creditor would have to file a lawsuit in a local court.

- Privacy: A Cook Islands LLC provides you with added confidentiality. Unlike many LLCs in the United States, you do not have to list Cook Islands LLC ownership on any public database.

- Reasonable costs: Setting up a Cook Islands LLC is relatively affordable and can be a more cost-effective financial option than domestic alternatives.

Protect Your Wealth with Offshore Trust Planning

Whether you’re a business owner, professional, real estate investor, or retiree, asset protection is a priority.

At Blake Harris Law, we partner with established offshore trustee companies to help clients develop comprehensive strategies for preserving their wealth in the best offshore trust jurisdictions.

If you want to set up a Cook Islands trust, our attorneys will guide you through:

- Trust Creation: Gathering essential paperwork and drawing up trust agreements.

- Funding: The legal transfer of real estate, investments, or other assets into the trust.

- Trust Monitoring: Appointing independent trustees to oversee and enforce the trust’s terms.

From the first consultation to ongoing support, our goal is to simplify the process and help you build a defensible structure. Consult with us today!