In the evolving landscape of wealth preservation, not all trusts are created equal.

As we look toward 2026, the gap between domestic and foreign asset protection strategies is widening into a chasm.

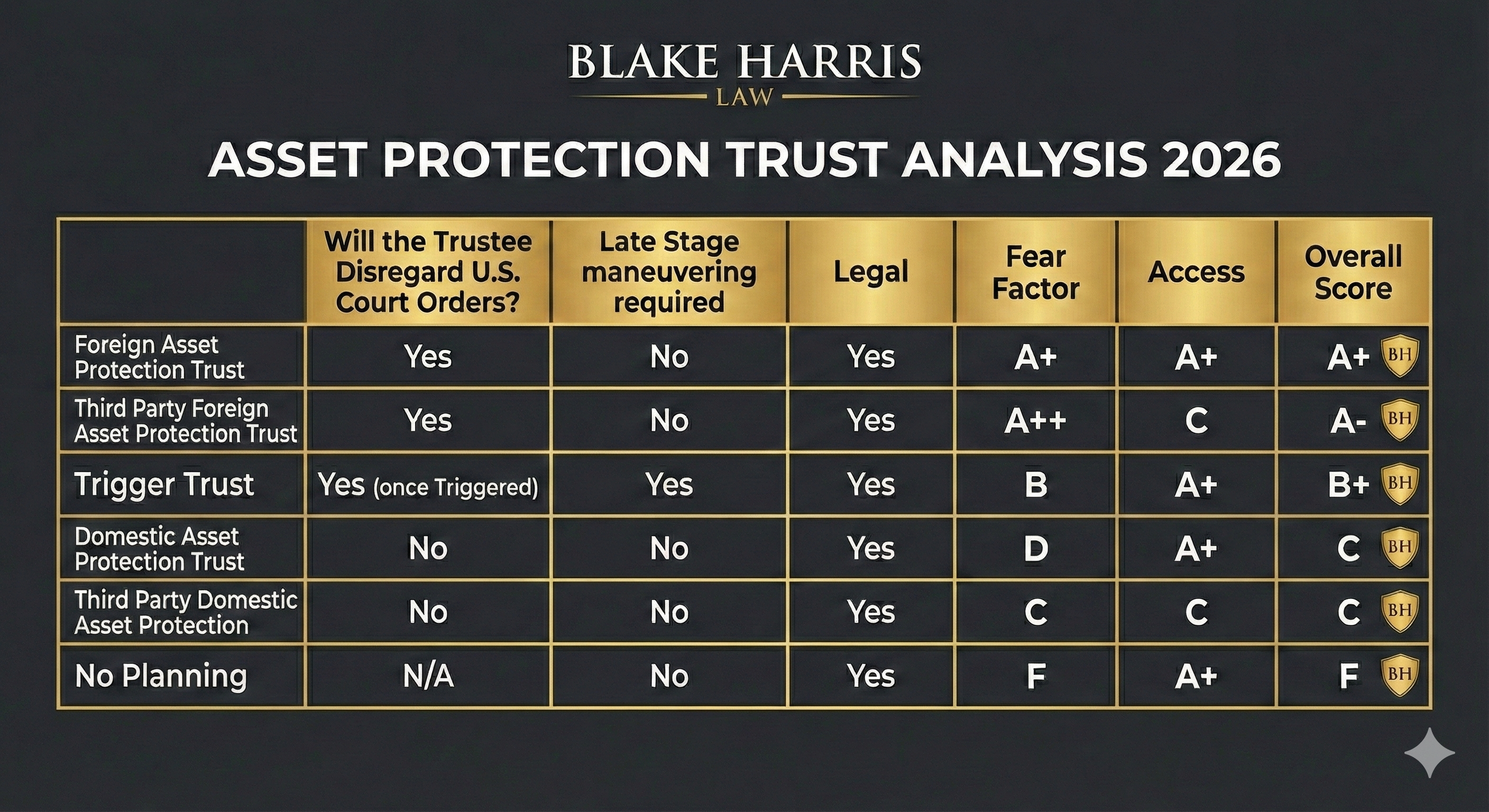

At Blake Harris Law, we conducted a 2026 analysis comparing the most common planning vehicles.

The results, summarized in the attached chart, highlight a critical reality: Jurisdiction is the ultimate determinant of security.

Here are the key takeaways from our 2026 Analysis:

1. The Domestic Weakness (DAPT)

Domestic Asset Protection Trusts (DAPTs) are failing to provide the necessary leverage. With a C+ Overall Score and, crucially, a “No” regarding whether the trustee will disregard U.S. court orders, DAPTs offer minimal deterrence against determined creditors. A “Fear Factor” score of D means litigants are not afraid to pursue these assets.

2. The Foreign Advantage (FAPT)

The Foreign Asset Protection Trust remains the gold standard, earning an A+ Overall Score. The critical differentiator is the first column: A foreign trustee is not bound by U.S. court orders. This creates the highest possible “Fear Factor” (A+), often stopping litigation before it even begins. It provides top-tier security without requiring late-stage maneuvering.

3. The Danger of Procrastination

The data regarding “No Planning” is stark. Straight F grades across the board. Furthermore, reliance on “Trigger Trusts” often requires “Late Stage Maneuvering,” introducing unnecessary risk when you need certainty the most.

Conclusion

The Verdict: If your goal is true peace of mind and leverage against frivolous lawsuits, offshore planning remains the best strategy.

Don’t settle for a “C+” defense of your “A+” portfolio.

Review the full analysis in the image below.